In MoneyWeek magazine this week: the pros and cons of investing in India; why you should set up an investment club; and can anyone really spot a bubble before it bursts?

Plus, a fast-growing property investment to buy now; niche alternatives to mainstream savings products; and a hidden gem of a value investing fund. All that, plus share tips and news from the markets, politics and economics. Sign up, and you’ll the magazine delivered direct to your door, full access to the MoneyWeek website and our smartphone and tablet app. Why not give it a go now?

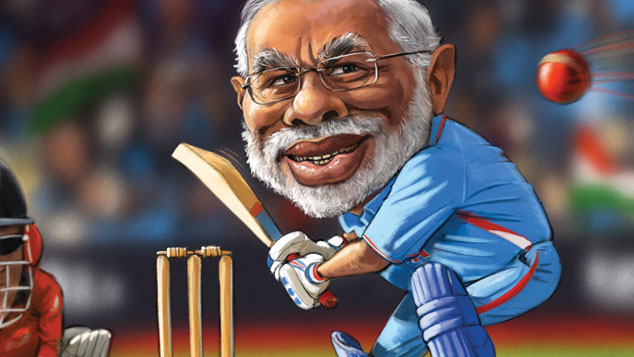

India: the world’s most exciting emerging market

Foreigners have “long been enamoured” by India, says Jonathan Compton. Its 1.3-billion population is young, it has “an enormous, well-educated middle class, a high savings rate, pockets of excellent technology, currently high economic growth… and the potential for a consumer boom”. That all sounds great. But India’s popularity with investors is misplaced, and there are just too many negatives. “India seems incapable of escaping its history, culture and perennially awful governments”. But the wider idea that growth in emerging markets will be driven by consumption is one that’s worth exploiting, says Jonathan. He picks four stocks to play that theme.

Rupert Foster, on the other hand, is convinced by India’s potential. Prime Minister Narendra Modi is a man who gets things done; he’s not afraid of tough decisions that may cause short-term pain, but will bring long-term gain. Rupert is particularly excited about the country’s move to a digital economy. He and picks five stocks to buy now that should profit as India booms. Find out what both Jonathan and Rupert really think Why not give it a go now?

The return of investment clubs

Many people would like to invest in stocks and shares but find the whole thing a little daunting. But, apart from subscribing to such excellent and informative publications as MoneyWeek, how can you hear from like-minded individuals, share information and make informed investment decisions? One very sociable way is to join an investment club, where you pool your money with friends, family members or colleagues to pool your money and dabble in the market.

They are usually made up of between five and 20 members who perhaps meet up once a month in the pub for a refreshing pint, glass of wine or fruit-based drink, and decide between themselves how to play the stockmarket. They’re not usually experts, by any means, just people with an interest in investing a little money. It can be as low as £15 a month.

They were hugely popular before the dotcom bust – there were around 10,000 of them in the UK in 2001. Now they’re undergoing a renewed popularity. Lucy Loewenberg looks at how they work, and how to go about setting up one of your own. Why not give it a go now?

Bubble spotting, Reits and niche savings products

“The word “bubble” gets bandied about a lot in investing”, says our executive editor, John Stepek. “Yet there’s no real agreement on what it means.” The trouble with bubbles is that they’re dead easy to spot once they’ve burst. But is it possible to identify one before it pops? John investigates.

Max King identifies a neat way to get in on the boom in commercial property. Driven by the internet shopping boom, the demand for warehouse space is going through the roof. Max picks a real-estate investment trust that invests in these “big boxes” and has so far produced a handsome return. And elsewhere, David Stevenson picks a “hidden gem” of an investment trust. “If you want to invest in small UK stocks, it’s worth having a look at this trust”, he says. Why not give it a go now?

And as interest rates continue to hover just above zero, there is some good news for saver, says Emma Lunn. “A new tribe of savings providers have thrown down the gauntlet to more established players in the market with a raft of eye-catching fixed interest rates”. Among them are Islamic banks and other unknown brand names. Emma explains why you shouldn’t fear to tread in the lesser-known areas of the market.

Of course, we’ve all the usual features, too. Matthew Lynn pops up with advice to the Tories on what to put in their manifesto. Simon Wilson looks at how local authorities could get their finger burned by speculating in the property market. And there’s all the best share tips from around the rest of the UK’s financial press. There’s property too; travel; wine, toys and even a crossword. Why not give it a go now?