Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

Before I get started today – this is your last chance to bid for a fancy lunch in London with my colleague Merryn Somerset Webb, courtesy of the FT. If you want to pick Merryn’s brains on bitcoin and Brexit, as well as things that actually matter to investors, then this is your opportunity. You can’t put a price on good company and stimulating conversation, but last time I checked it was around £2,200 – an outright bargain. Better yet, the money goes to an extremely good cause – Alzheimer’s Research. So get your bids in here.

Back to this week – after a week of to-ing and fro-ing, and much predictions of the sky falling in, Theresa May finally managed to seal the deal on the first phase of Brexit.

It was a massive fudge, just as pretty much everything involving the EU is. But it’s a step towards an eventual conclusion. It suggests that some sort of deal will be done whereby Britain leaves the EU and everyone gets on with their lives. A bit like the scenario outlined in Merryn’s editor’s letter in the magazine a few weeks ago.

I’m not going to spend a lot of time covering this because it’s going to roll on for a long time and most of it won’t be that relevant to long-term investors (and as for short-term trading, it’s anyone’s guess).

The only thing I’d suggest is that I’d imagine that sterling is probably now going to see more strength, although equally I can’t see it getting back to pre-Brexit levels anytime soon (not that this is necessarily a bad thing). So if you made a lot of money as a direct result of sterling falling (by deliberately positioning your portfolio in overseas assets for example), then that trade is probably done now.

But beyond that, I think the key thing to remember as an investor – and to avoid getting distracted by all the headlines on this stuff – is this: negotiations are always fraught, particularly with something as complex as the EU – remember all the last-minute mercy dashes to stop Greece from leaving? And all the “red lines” that were drawn and erased in the process? That’s negotiation for you. So there will be many more last-minute battles, points at which everything looks to be on the verge of collapse, and a lot more hysterical headlines.

Another thing to bear in mind is that a lot of people are invested in this process failing. Here’s just a selection: Corbyn fans (they want to leave the EU but want the government to fall in the process, so any signs of success will be decried); hardcore Remain voters (everything bad that happens from now on will be a result of us leaving the EU, regardless of how many years from now it occurs); and hardcore Leave voters (everything bad from now on will happen because we’re still in the EU and we’ve not left it properly!) They will never see or accept any good from this deal. So don’t expect an outpouring of positivity in the next five to ten years.

But gradually all of the people who feel strongest about this will take up less and less space on our front pages, and the rest of us will just get on with stuff.

The real risk that investors have to consider is the danger that Jeremy Corbyn gets his mitts on the reins of power at some point. Merryn had put together a piece on how to prepare for that particular risk right here.

And what was the other big story? Oh yes, that digital currency thingy. I’ll save that for the next section.

Time for our regular charts

Now we’ll turn to our charts, but first, if you missed any of this week’s Money Mornings, here are the links to catch-up.

Monday: Trump manages to get some work done – what does it mean for investors?

Tuesday: How Donald Trump could finally pop the bond bubble

Wednesday: Made money in bitcoin? Well done. Here’s what you must do now

Thursday: What is the yield curve, and why is it making investors nervous?

Friday: How the 1930s banking crises prolonged the Great Depression

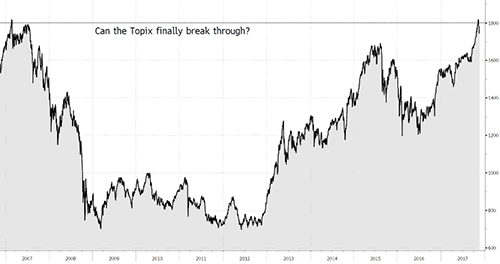

I’ve – at least temporarily – added the Topix index, Japan’s key stockmarket, to our list. (In Japan, the Nikkei is analogous to the Dow Jones; the Topix is the S&P 500). Here’s why.

The Topix index hasn’t managed to claw back above the 1,800 level since the collapse of the Japanese bubble at the beginning of the 1990s. Jonathan Allum at broker SMBC Nikko describes the level as “the iron coffin lid”. As the chart below shows, the last time it was challenging this level, was in 2007.

The Topix started the week with its head just above 1,800. It slid back during the week, but now it’s managed to regain that level.

If the market can break above it convincingly, it would be a very bullish sign – although, as I said last week, there’s also a really manic feel to markets right now. So maybe this is top of the market time again.

Gold had a bad week. The $1,270 per ounce mark finally gave way. No one likes gold anymore. It doesn’t go up by 30% in half an hour, like bitcoin. It’s not shiny and new, yet also invisible, like bitcoin. It’s not incredibly hard to sell, like bitcoin.

Currently, it’s the anti-FOMO asset (for people like me who always have to Google acronyms, FOMO stands for “fear of missing out”). It’s more like the FOBSH (fear of being seen holding) asset.

I have a dreadful tendency to side with the underdog, and I do have a soft spot for assets that I can be relatively confident of being able to sell in extremis. So I’ll be hanging onto gold.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – climbed this week, assisted partly by US president Donald Trump finally getting some legislation through.

(DXY: three months)

Meanwhile, the yield on ten-year US Treasury bonds stayed just below the 2.4% mark that’s seen as a major line in the sand by many analysts. This seems odd – Trump’s tax plan should add up to fiscal stimulus (in other words, you have loose monetary policy and higher government spending too). In turn that should be inflationary and investors should be expecting higher interest rates in the future.

What’s the story? What is the yield curve, and why is it making investors nervous?. I can see why investors feel nervous. Everything feels rather bubbly, which suggests that fleeing the ‘safety’ of government bonds is a mistake.

And yet, maybe bond investors are frightened of the wrong thing. Maybe years of ultra-low rates have conditioned them to own government bonds – just as no one in 1999 thought it was a good idea to sell tech stocks. I don’t know. We’ll see.

(Ten-year US Treasury: three months)

Copper was slammed this week. The main concern remains Chinese demand for the metal, which appears to be falling even as supply is improving.

(Copper: three months)

And now we turn to bitcoin. To make all of you feel better (if you own bitcoin you can be smug; if you don’t, we can commiserate), I want to share my bitcoin regret story with you.

I opened an account with Coinbase in June 2015. (I checked back in my emails, just to pick at the scab). I got about halfway to buying some bitcoin. Then the sheer clunkiness of the process and the worrying amount of personal information I was having to hand over just put me off. In short, it was too much hassle.

Don’t get me wrong, I wouldn’t have bought much – I planned to buy £100, and then to try to spend some of it. I didn’t want to invest – I already thought it was probably overvalued – I just wanted to experiment with this new tech we kept writing about.

So I am not kicking myself too badly. I wouldn’t be sitting on a life-changing sum now. But I do have to point out that back then, bitcoin was trading at roughly $250 a coin. So if I’d bought that £100 and then just ignored it, it would now be worth more than £6,000.

Not life-changing, but it is at the point where I do feel a teensy bit regretful about the replacement car I could have got for that, for example…

Anyway – bitcoin has continued on its merry way higher this week, and it shows no signs of stopping. If you own it, take Dominic’s advice – Made money in bitcoin? Well done. Here’s what you must do now.

(Bitcoin: ten days)

This week, the four-week moving average of weekly US jobless claims dipped, to 241,250, while weekly claims fell to 236,000. According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a “cyclical trough” (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

As the chart below shows, the most recent cyclical trough was just a couple of weeks ago, at 231,250. So we could still be some way from the peak.

(Four-week moving average, US jobless claims, year-to-date)

The oil price (as measured by Brent crude, the international/European benchmark) hasn’t changed much this week. Traders are digesting the post-Opec excitement – can extended cuts by Saudi and Russia really offset the likely return of shale oil and concerns about the Chinese economy slowing down? It’s something we’ll all just have to keep an eye on.

(Brent crude oil: three months)

Finally, internet giant Amazon rallied somewhat this week, although the Nasdaq and tech stocks in general is having a harder time maintaining gains than the wider markets. Signs of a rotation? Possibly. Some of this will depend on what happens with the tax and overseas cash repatriation rules.

(Amazon: three months)