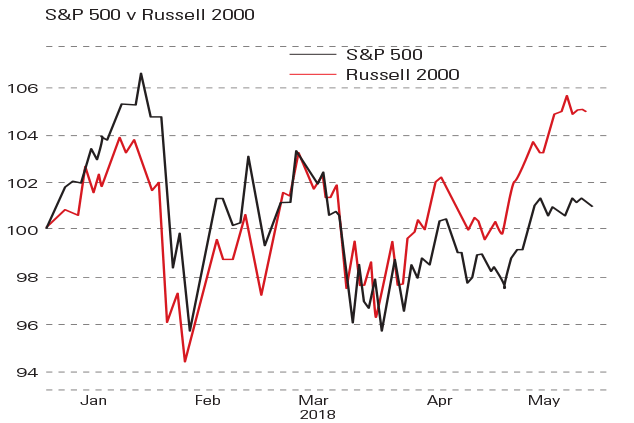

The Russell 2000 small-cap index has gained 6% since 1 January; the S&P 500 index of blue-chips is barely in the black. The prospect of higher interest rates often sends investors back into large caps, as they are solid firms that tend to cope better with dearer money. But several factors are now fuelling demand for higher-risk, higher-reward small caps. The recovery in the dollar squeezes the large-caps’ foreign earnings, while smaller firms are more domestically orientated; their import costs are now lower. The US economy has looked sprightlier than its major counterparts recently. Small caps also stand to benefit more from the corporate tax cut, which will represent a bigger proportion of their earnings.

Viewpoint

“[Even] the weak pace of growth that Britain has experienced recently appears to have been driven by personal consumption and households are financing that consumption with their savings rather than with income… If Britain is to prosper, growth needs to come from getting companies to invest and from selling more goods and services [overseas]… uncertainty over Brexit is affecting business investment, and for good reason. Investing in plant and equipment or engaging in hiring plans is a long-term commitment. It can’t be switched on and off. [Firms]… rationally are waiting to judge what opportunities are available when Britain has left the European Union. So long as the government is unclear on this point, the economy is likely to continue [stagnating], save only for further consumption driven by… savings. That’s no basis for a healthy economy.“

Oliver Kamm, The Times