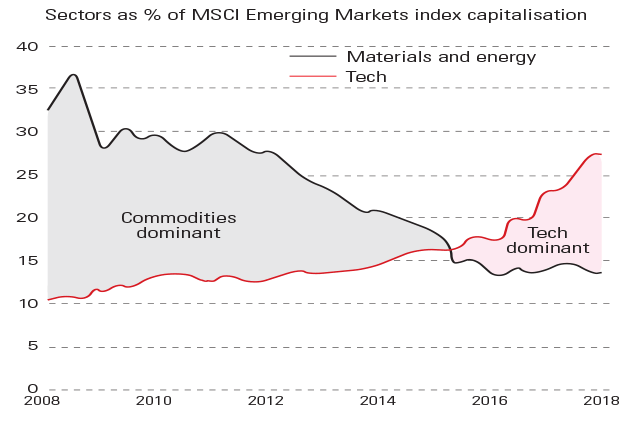

Investors tend to associate emerging markets with commodity producers. And no wonder: a decade ago raw-materials companies accounted for 37% of the benchmark MSCI Emerging Markets index. But times have changed. Technology is now the single biggest sector, comprising 27% of the index, up from 10% in 2008. A strong dollar, which makes commodities more expensive for investors outside the US, has provided an additional tailwind in the past few months. Emerging markets have gone from Brics to clicks, notes Kate Allen in the Financial Times. The new tech giants include Chinese firms Baidu, Alibaba and Tencent, along with South Korea’s mobile group Samsung and Taiwanese semiconductor maker TSMC.

Viewpoint

“The political, diplomatic, technical and intellectual work that goes into the management of [Brexit] will allow for few other undertakings of real weight… Leavers will contest this neat line between constitutional change and the ‘real’ work of government. They see the EU’s curbs on a member state’s freedom of action as the true block on domestic reform. A bold government must be sovereign in the first place. But even leaving aside the obvious rejoinder (which Thatcherite idea was stymied by Brussels?), there are only so many hours in a day… Central to politics is the picking of battles, and Britain has picked an all-absorbing one… [it] volunteered for a new challenge before fixing such old ones as productivity and infrastructure. … These are the Lost Years. We can but guess how many of them there will be, and what we might have done with them instead.”

Janan Ganesh, Financial Times