Welcome back.

If you hurry, there should still be time to get a ticket for our event on in London on 12 February. I’ll be talking to MoneyWeek regular Tim Price and Netwealth’s Iain Barnes about the latest goings on in the market. We’ll be covering everything from inflation and interest rates to Brexit (wherever we are with it by then) and global equities. And we’ll all hang around for a chat afterwards – hope to see you there.

We have a new podcast for you this week, in which we don’t talk about Brexit at all, and if you missed any of this week’s Money Mornings, here are the links you need.

Monday: “2019 will be the year of the stock-picker” – and other nonsense to ignore

Tuesday: Good news for gold mining investors – merger mania is gripping the sector

Wednesday: What May’s massive Brexit rejection means for your money

Thursday: How Jack Bogle transformed the investment industry for the better

Friday: What does 2019 hold for UK house prices?

Don’t miss Merryn’s blogs – here she is on the scandal of financial industry fees, and how big earners in glasshouses should be careful of lobbing stones at one another; and if you’re contemplating divorce and you’re not as rich as Jeff Bezos, then check out why you should put it off for another couple of months at least.

And if you’ve made a New Year’s resolution to get on top of your finances, then a subscription to MoneyWeek will put you well on the way there.

The investment world lost a genuine hero this week. If you don’t know who Jack Bogle was, How Jack Bogle transformed the investment industry for the better – he probably saved you a lot of money.

And now, over to the charts.

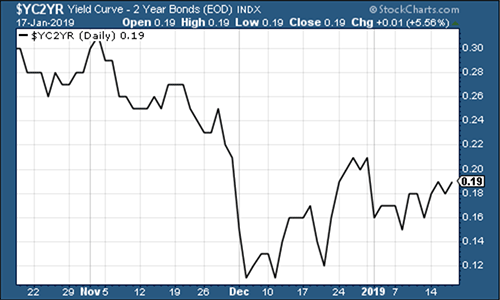

The yield curve (here’s a reminder of what it is) didn’t budge much this week, although it did tick a little higher. The good news is that it still isn’t pointing to a recession; the bad news is that it’s still very close to doing so.

The chart below shows the difference (the “spread”) between what it costs the US government to borrow money over ten years rather than two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) has been more subdued this week as the dollar rallied a bit and markets considered returning to “risk-on” mode. MoneyWeek regular Charlie Morris gave us his view on gold this week – I recommend you read his piece.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – rallied somewhat this week, which is an early warning sign for risk assets, although we’ll see how far it can get.

(DXY: three months)

The ten-year US Treasury bond yield was little changed this week. It was a similar story for other developed world government bonds – the Japanese government bond (JGB) yield edged lower, while the ten-year German bund yields (the borrowing cost of Germany’s government, Europe’s “risk-free” rate) rallied a little.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

Copper rallied a little this week, mainly on hopes that China and the US can come to a trade deal that works for both of them.

(Copper: three months)

The Aussie dollar – our favourite indicator of the state of the Chinese economy – ambled around the $0.71 mark. Hopes for a resolution of America and China’s trade differences battled with concerns that the Chinese economy is slowing fast and there’s no sign that the government’s efforts to loosen monetary policy are offsetting it as yet.

(Australian dollar against the US dollar: three months)

When it comes to cryptocurrency bitcoin I still can’t work out what drives it, but it’s clear that it’s neither a risk-on nor a risk-off asset – there’s not an obvious correlation (not obvious to me anyway) between what the wider market does and bitcoin’s movements. It’s not as volatile as it once was though.

(Bitcoin: ten days)

The four-week moving average of weekly US jobless claims edged lower this week to 220,750, as weekly claims came in at a lower-than-expected 213,000.

Gluskin Sheff’s David Rosenberg has noted in the past that US stocks typically don’t peak until after jobless claims (as measured by the four-week moving average) have hit a low for the cycle.

On average, the peak follows about 14 weeks from the trough. A recession follows about a year later. (As always, a reminder that this is taken from a small sample size with a lot of variation.)

You can see the most recent trough in the chart below – it was on 15 September, at 206,000. That would suggest that the stock market has already peaked, and would imply a recession late this year or in 2020. That scenario does not seem ridiculous by any stretch of the imagination.

Yet we can’t rule out another trough either. For now, I’d say this indicator is still way too close to call.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) managed to hold above $60 a barrel by the end of the week. Saudi and Russia have been cutting production again. Iranian oil exports are down too. And it helps that investors are simply not that bullish on oil right now – it’s a market where sentiment makes a big difference and swings around quite wildly – typically when investors are highly bullish you can expect a reversal, and the same goes for the other way around.

(Brent crude oil: three months)

Internet giant Amazon continued to rally. It’s worth keeping an eye on – if Amazon gets back into a clear uptrend, chances are that the late-2018 panic will be in the rearview mirror.

(Amazon: three months)

Electric car group Tesla had another decent week as the wider market recovered, but it then ran into trouble on Friday as the company warned of job cuts and the challenge it faces in making its cars competitive.

(Tesla: three months)

Have a great weekend. And don’t forget – get your ticket for our event here – given the state of our politics right now, it’s one hope to see you there.