Welcome back. The podcast has returned from its inadvertent August break!

Merryn and I talk about shutting down parliament, virtue and certainty, negative bond yields and what might be causing them, the end of the monetary system as we know it, and all the other things we didn’t get round to recording this month. Check it out here.

And if you like podcasts, I also popped up on the podcast from our sister magazine, The Week – I was trying to explain what might happen when the US dollar is replaced as global reserve currency, while the discussion also covered facial recognition technology and the literary merits of Enid Blyton.

I’m getting more and more excited about the MoneyWeek Wealth Summit in November. We’ll be revealing more details about the line-up very soon but we’ve had a few high-profile additions just this week. It’s going to be a very full day, packed with insights into the unprecedented monetary and political backdrop. Seriously, book your ticket now – it’s in London on the 22nd November.

If you missed any of this week’s Money Mornings, here are the links you need:

Tuesday: The US dollar’s days as the world’s most important currency are numbered – it’s official

Wednesday: Fed up with your kids’ school? Home educating might be easier than you think

Thursday: What shutting down Parliament means for your money

Friday: More good news from the UK property market – house prices aren’t going anywhere

Currency Corner: The New Zealand dollar vs the Japanese yen

Subscribe: Get your first 12 issues of MoneyWeek for £12

Oh and you may have noticed that we’ve re-launched Money Minute (hitting your inbox every morning at 7AM) – but this time as a video rather than a micro-podcast. I’d love to hear what you think of it. Drop us a line at editor@moneyweek.com (put “Money Minute” in the subject line) or contact me on Twitter at @John_Stepek to let me know if you find it useful.

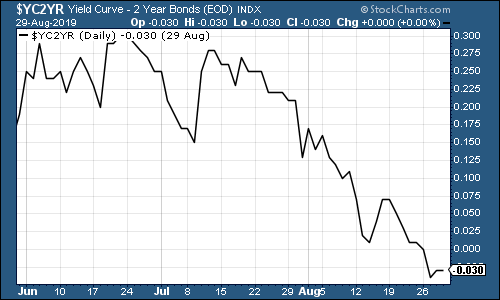

Onto the charts. The yield curve has inverted again (if you need a reminder about why the yield curve matters, here you go). In short, this means that the gap between the yield on the ten US government bond and the yield on the two-year has turned negative (in other words, it costs the US government less to borrow for ten years than for two).

When that happens, it’s a pretty reliable indicator that a recession is coming. So sell everything? Maybe not, because history suggests that it could be up to two years before it gets here.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) has continued higher though its progress slowed towards the end of the week as the US dollar strengthened.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – headed higher this week, which is not going to be welcomed by Donald Trump or markets in general.

(DXY: three months)

Meanwhile, the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) continued to rise as the Chinese currency weakened. We’re now significantly above the ¥7.0 level that everyone had viewed as a line in the sand until recently.

(Chinese yuan to the US dollar: three months)

As for 10-year yields on major developed-market bonds – yields continue to fall, and there’s no real sign of a turnaround. Here’s the US 10-year yield:

(Ten-year US Treasury yield: three months)

And Japan:

(Ten-year Japanese government bond yield: three months)

And Germany…

(Ten-year Bund yield: three months)

Copper bounced a bit, probably the market clutching at straws of hope that a trade deal might materialise.

(Copper: three months)

The Aussie dollar started to wilt at the end of the week in the face of relentless US dollar strength.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin slid beneath the $10,000 mark.

(Bitcoin: ten days)

US weekly jobless claims met expectations at 215,000. The four-week moving average came in at 214,500.

US stocks typically don’t peak until after this four-week moving average has hit a low for the cycle, and a recession tends to follow about a year later (remember that this again, is from a tiny sample size, originally highlighted by David Rosenberg at Gluskin Sheff). The last low came about three months ago, at around 201,000.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) rallied as more investors start to think that supply might be tighter and demand higher than markets imply.

(Brent crude oil: three months)

Internet giant Amazon was little changed this week.

(Amazon: three months)

Electric car group Tesla headed higher.

(Tesla: three months)

Have a great weekend, and allow me a quick plug of my book as usual – The Sceptical Investor is all about contrarianism and keeping your head in markets when all around you are losing theirs. Which is quite topical just now, really. Get your copy here.