One of the most important parts of our work is to correctly identify primary bull and bear markets and decide whether they are in the process of, changing. It is important because there has been such a large recent negative sentiment swing for gold and oil, both of which have fallen from their recent all-time highs.

We must first ask ourselves “Are we short-term speculators or long-term investors?” The answer to that is absolutely crucial to all of our investment decisions.

Short-term speculators, which we aren’t, mostly use borrowed money; long-term investors, which we are, invest their own money, but both buy and sell the same assets. The problem is made more complicated because even the best of the financial press reports action and takes comments from both sides without differentiating. If you are a long-term investor, the views of a short-term speculator are mostly unimportant, even dangerous, and for a short-term speculator, the views of a long-term investor might, in certain cases, be ruinous.

To be successful long-term investors, which is our aim, relies upon our ability to identify genuine primary bull markets and to remain invested in them for the duration whilst grimly avoiding primary bear markets and recognising the difference.

Gold bullion and gold mining shares

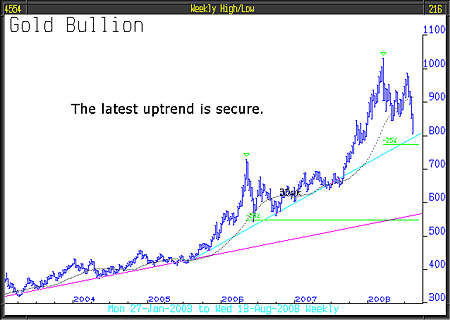

Below you will see a weekly chart for gold bullion from 2001, it is still a primary bull market. The latest uptrend from 2005 remains secure and the pullback this year is, to date, less than a similar pullback in 2006. If, like us, you believe the bull market for gold is still secure, now is a huge buy opportunity which we expect long term investors to embrace.

It is generally agreed that gold bullion is inversely correlated to the US dollar, so the recent strength of the dollar would have added some extra negativity to gold sentiment. However, the previous period of dollar strength from July 2005, was also a positive period for gold bullion.

Graham Birch, head of the Natural Resources Team at BlackRock has recently written about gold. The following paragraphs are extracts from that report:

“Short term trends have been negative for gold and other commodities due to recovery of the US dollar, a wobble in the Chinese economy and the weaker oil price (implication of lower inflation). Investors have demonstrated little tolerance of risk and are behaving like sheep – herded into commodities when momentum was positive and now being herded back out at lower levels. The impact of this money sloshing in and out of the commodity markets is to temporarily swamp underlying fundamentals. In the case of gold, the market remains in structural shortage with global mine output declining for years to come due to lack of investment and poor historic exploration success.

Gold shares have underperformed the gold price and over the last year the BLK Gold & General Fund is flat. It has declined by over 30% from its recent high. This leaves gold share looking very attractive relative to gold bullion – they have not looked as attractive at any point in this bull market for gold.

“Even though gold shares feel very risky due to their high volatility we believe that the intrinsic risk has declined materially. History has taught us that the best time to buy the BlackRock Gold & General Fund is when all your instincts are telling you to stay away.”

Oil and oil shares

Much that we have said about gold also applies to oil. The bull market remains secure and the underlying fundamentals are broadly unchanged. Chindia and the oil producing nations’ economies, continue to expand at a significant rate. China will become the largest economy in the world, probably sooner than expected, and their demand for energy will grow exponentially.

The oil price has been negatively affected by the stronger dollar and some demand destruction on the slowing of the developed world’s economies. As well as some demand destruction, the net non-commercial open position on NYMEX moved to a net short position for the first time since February 2007. In the third week of the month the position moved from 22,400 contracts long to 3,700 contracts short and remained in that net short territory. Short term speculators were blamed for the high rise of oil, they are now part of the cause of the pullback

Long term, the fundamental condition has not materially changed. Of importance is the risk to future global oil supply. The following paragraph is from a recent report by Investec Asset Management:

“A lack of exploration success, skilled engineers and infrastructure has led to disappointing OPEC and non-OPEC production. We believe that these disappointments will persist. Non-OPEC growth might be as low as 150,000 barrels per day in 2008, highlighting that the industry is unable to deliver any supply growth in response to high prices and in spite of its investment programme, there has been little new OPEC growth. We believe that the industry needs to carry out at least a further ten years of significant infrastructure investment to delivery any meaningful production growth and to rebuild a reasonable spare capacity cushion. This is an exceptionally robust long-term outlook.”

In 2006, the oil price corrected by 33.33% – the amount of this recent correction is less than that and brings it into clearer focus.

It is estimated that the current price of energy equities reflects a medium to long term oil price of $53 to $60 per barrel. If however, over the current period of price uncertainty, we see the oil price consolidating above $100, and we expect that, it could lead to an eventual upward re-rating for the equities. The potential here is significant. The fundamentals are positive and the current depressed equity rating will almost certainly prove to be wrong.

NOTE: Our investment opinions are good for the day only, events could develop to cause us to change our view, in which case we will have no hesitation in taking different action.

• This article was written by John Robson & Andrew Selsby at Full Circle Asset Management, as published in the threesixty newsletter on 14 August 2008