The big set-piece event of the week is the Chancellor’s Pre-Budget Report, scheduled to be delivered at 3.30pm on 24th November. In keeping with the post-tumult environment, attention is firmly focused on the size and scope of the already signalled fiscal boost. Will it be tax cuts? Will it be increased spending? Will it be both? What will the effect be on the ailing public finances? Will it matter, particularly now that the earlier fiscal rules have been smashed to smithereens? Frankly, the government is right to go for broke as recessionary conditions set in and look to become progressively worse. Monetary policy is being eased by a Bank of England which has finally got the message and now we will see to what extent the complementary fiscal strings are to be loosened. Attention has focused, inevitably, on the potential long-term cost associated with additional borrowing on top of an increasingly parlous fiscal position. However, it should be noted that if nothing were done and macro economic activity allowed to follow its natural course, this would very likely be a prolonged and deep recession. By contrast, if drastic measures do prove successful and the economic corner is turned sooner than expected, the longterm upshot of opening the sluice gates to the max is that the fiscal position might actually improve!

Economic output forecasts

What will be just as significant as the size and shape of the projected fiscal largesse is the extent of the toe-curling embarrassment relating to economic forecasting. There is now absolutely no doubt whatsoever that Mr Darling will have no choice other than to tear up earlier forecasts, both for this year and for next, although he will, of course, lay the blame for this squarely on international factors.

GDP Forecasts

| %y/y | 2008 | 2009 | 2010 | 2011 | 2012 |

| Budget Mar 08 | 1.75-2.25 | 2.25-2.75 | 2.5-3.0 | 2.5 | 2.5 |

| PBR (poss) | 0.75-1.00 | -0.5-0 | 1.5-2.0 | 3.0 | 3.0 |

In the March Budget, the Chancellor forecast growth of 1.75% – 2.25%. In the light of the marked deterioration over the autumn we now expect that forecast to be lowered to just 0.75% – 1.0%. The real problem comes next year. A prolonged recession would play havoc with a Budget forecast for growth of 2.25% – 2.75%. The most recent consensus forecasts a contraction of -0.2% and will have deteriorated yet further over recent weeks. It will be extremely interesting to see whether the Chancellor really bites the bullet and forecasts an outright fall in economic activity for 2009. This may prove a step too far for now, although further downgrades are very likely at next year’s Budget. Thereafter, it is to be expected that Mr Darling will opt for positive spin imparted, one imagines, by the likelihood that the spare capacity created by the prevailing slowdown will, in due course, pave the way for faster growth.

Public borrowing forecasts

Just as the outlook for economic output forecasts has deteriorated, so lowered expectations will feed through to a more downbeat picture of fiscal projections. At the March 2008 Budget Mr Darling forecast that Public Sector Net Borrowing (PSNB) would fall from £43bn in 2008-09 to £30bn in 2009-10 and further in subsequent years. Inevitably, recent events have caused to make these forecasts look very out of date. This year’s borrowing number is likely to exceed £60bn, while the numbers for future years are likely to emerge even higher (see table below).

Forecast Public Borrowing

| £bn | 08-09 | 09-10 | 10-11 | 11-12 | 12-13 |

| Mar 08 | 43 | 38 | 32 | 27 | 23 |

| PBR (poss) | 55 | 75 | 90 | 100 | 100 |

It should be noted that if we included the prevailing numbers from Capital Economics, our economic data flash provider, the numbers might look more like this…

| 60 | 90 | 120 | 150 | 160 |

On the basis that Mr Darling’s economic growth forecasts are likely to be more benign; his PSNB forecasts are likely to be less apocalyptic. That being said, weaker output growth, coupled with a package of fiscal largess, will inevitably result in higher borrowing totals over the years ahead.

The key take away from this analysis is, however, that whatever Mr Darling announces by way of backdrop to his fiscal measures, there will, at some point in the future, have to be a significant retrenchment unless economic growth can bounce back very aggressively, much faster indeed than anybody presently envisages. That retrenchment will be necessary in order to get the public finances back into a position of stability and will, inevitably, cause future economic growth forecasts to be scaled back.

Market Impact

The Pre-Budget Report will confirm that UK borrowing has risen to record levels (not including PFI chicanery!). Attention is likely to focus on the gilt-edged market as this and further commitments to bail out the financial sector are unlikely to play out particularly well. According to the Debt Management Office, the Central Government Net Cash Requirement reflects the sharp increase in borrowing and is likely to result in gilt-edged sales of c£110bn in the current financial year. In fact, an extra £30bn gilt-edged issuance to fund the bank’s recapitalisation seems certain to push that figure even higher. Even more scarily, the economic recession, deeper and longer than those of the recent past, seems certain to result in even more substantial issuance in years ahead. Capital Economics is forecasting c£185bn issuance in 2011-12 and possibly even more if further capital injections into the banks were required.

Turning to the demand side of the equation what we know is that institutional demand for gilt-edged remains very strong. Asset / liability matching requirements suggest to us that issuance is likely to be skewed towards the longer end of the duration curve. In addition, index-linked yields have fallen to c1% of late, despite the current hoopla regarding deflation. This paradoxical performance reflects, to us, the fact that many investors are looking through this deflationary episode towards a resurgence of inflationary pressure thereafter. For this reason we expect institutional demand for index-linked in the medium term to be reflected in government issuance at that duration.

Having considered gilt-edged supply and demand we might say a word on the market’s possible reaction. Most will recall the negative response accorded the news of the government’s £37bn injection into the banking sector. It is far from inconceivable that we will witness a similar convulsion in the gilt-edged market when the Chancellor’s proposals are unveiled. If such a convulsion were to result in a prolonged period of higher yields at the long end of the curve, public finances could be dealt a further blow as debt servicing costs rise.

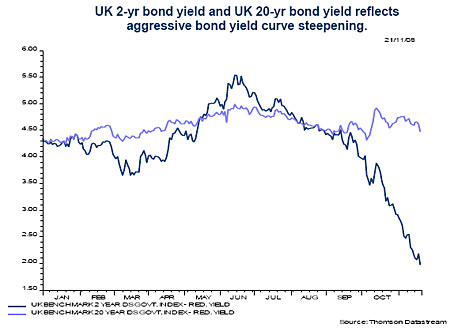

In fact we do not expect long dated bond yields to maintain their strength for long. The combination of the rapid descent into recession, coupled with an equally dramatic slide towards deflation, should be sufficient to push bond yields lower again after a short hiatus. The bond yield curve will steepen for sure, but largely because of further aggressive base rate reductions and their impact on the short end of the curve. As for other markets, we look for a mildly positive reaction from the equity market on confirmation that the government is now doing all it can in its attempts to head off a prolonged slump. By contrast we expect sterling to react badly to concerns regarding higher borrowing and the dire state of the public finances. The only thing preventing an all-out collapse in the pound is that in the foreign exchange glue factory all the old nags, sterling, the dollar and the euro, look equally worn out.

• This article first appeared in Week in Preview, published by Charles Stanley stockbrokers .