The FTSE 100 has stalled ahead of its traditional summer lull. The next big test of confidence will be the quarterly earnings season, which kicks off shortly. Homeserve is due to update investors at its AGM on 31 July.

The firm aims to be the “AA of domestic emergencies” – providing households with service plans that allow owners to ring a toll-free number whenever they need an electrician, plumber or other qualified tradesmen.

Typical call-outs are for burst pipes, blocked drains and faulty electricity/central heating systems. But for those families who do not want to be tied to an annual contract, Homeserve also offers a pay-as-you-go option, where engineers work for a fixed fee.

The media have recently publicised many cases of cowboy workmen charging exorbitant rates for minor repairs. This has led to a huge surge in demand at Homeserve, which now boasts 9.2 million policy-holders. A typical customer is elderly and willing to pay, on average, £80 a year for the comfort of having 24/7 emergency cover.

Homeserve (LSE: HSV), rated BUY by Arden Partners

However, I think the shares could soon spring a leak. In May Homeserve reported that its client base was shrinking. Meanwhile, the competition facing its wholesale division (contributing 8% of profits), which works on behalf of insurers, is so tough that it is quitting the business at a cost of £97m.

This makes strategic sense, but such cut-throat competition doesn’t bode well for its lucrative direct-selling unit. This generates juicy Ebita (earnings before interest, tax and amortisation) margins of 32%. As margins like that get compressed, either Homeserve will have to pay fatter commissions to its own affinity partners, such as the water companies, or respond with lower prices.

Lastly, as the British market matures, Homeserve is being forced to expand abroad through subsidiaries in Belgium, France, Spain and America. This is an admirable attempt to find new sources of long-term profits. But a strategy of aggressively expanding overseas at a time when most Western families are cutting back is fraught with danger.

The City is forecasting underlying earnings per share of 111p and 120p for the next two years. Those figures put the stock on p/e multiples of 12.6 and 11.6 respectively. These look ambitious for a consumer-facing organisation with no real experience of weathering a downturn.

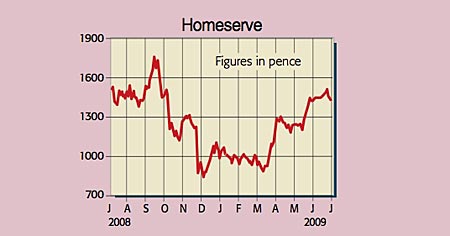

I rate Homeserve on a through-cycle Ebita multiple of just eight, assuming sustainable profit margins of 25%. After allowing for £34m of net debt, this suggests a share price of around £9.50. With cancellations likely to rise as households tighten their belts and little prospect of product price increases, the stock offers far more downside than upside. The directors seems to agree – the CEO and chairman recently sold £0.7m of shares at £14.84.

Recommendation: SELL at £14.02p

• Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments