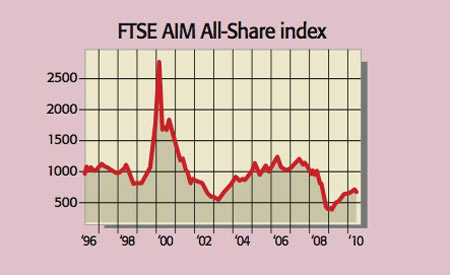

On 19 June, London’s Alternative Investment Market (AIM), the London Stock Exchange’s secondary market to fund small growth companies, celebrated its 15th birthday with a hot-air balloon launch. But long-term investors have little to cheer about, says Nick Hassell in The Times. The FTSE AIM All-Share index has fallen by nearly a third since its inception. That compares to a 64% increase in the FTSE All-share index. The flight from risk during the credit crunch has reduced the number of listings by 25% over the past two years. And thanks to the junior market’s ‘light-touch regulation’ it has had its fair share of corporate scandals.

Still, there are also plenty of AIM success stories, such as Domino’s Pizza and online retailer Asos. Moreover, as Graeme Davies points out in the Investors Chronicle, it still offers a huge range of investment opportunities. These include biotechs, Chinese-food producers and African medical companies. For now, however, the index may continue to struggle. With the economic outlook darkening, economically sensitive and risky small caps are especially vulnerable to a relapse.