This consumer goods company is a solid firm – but wait till the price is right, says Phil Oakley.

It’s not hard to see why consumer goods companies are so popular with investors. Customers trust branded goods. Once they find a brand that they like, they will stay loyal to it for years to come. This means that demand for top branded products tends to hold up well regardless of how much the economy is suffering. In fact, companies are often able to keep on charging just a little bit more for them every year, especially when raw-material costs are going up.

So leading consumer-goods companies such as Unilever, along with similar ones such as Reckitt Benckiser, Colgate and Procter & Gamble, are in demand. In an uncertain world, they can mostly be relied upon to keep growing their sales, profits and dividends, certainly more so than the majority of companies. Given the alternative of having money stuck in a low-interest savings account, millions of investors have decided to put their money into these dependable, dividend-paying, blue-chip shares instead.

Unilever, whose brands include Persil, Dove, Domestos and Wall’s ice cream, wasn’t always dependable though. For much of the last decade it was constantly criticised in the City for not doing as well as its competitors. It was good at cutting costs, but lacked the focus and cutting edge of a business such as Procter & Gamble, and was losing out to rivals.

And make no mistake, this is a cut-throat business. You just have to walk down a supermarket aisle to see how the big consumer brands are constantly offering enticing deals so that their product ends up in your trolley.

Thankfully for Unilever investors, in 2009 the company poached Paul Polman from Nestlé to sort it out. He got rid of the obsession with hitting the City’s quarterly profit forecasts and set about changing the culture of the company. The focus was to be on the long term, prioritising product innovation, selling more to emerging markets, and generating cash.

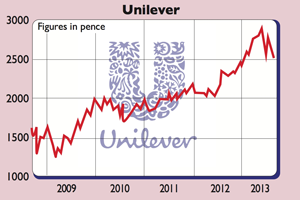

Polman has done a good job. The share price and dividends paid to shareholders have grown nicely under his leadership on the back of selling a lot more products to emerging markets such as China, India and Latin America. But, as good a company as Unilever is, is it a buy at today’s prices?

Can Unilever keep growing?

Professional investors are becoming a bit nervous about Unilever. Back in May the shares were very much flavour of the month and topped 2,900p. Since then they have slipped back by 15% as fears grow that emerging markets – from where it gets around 60% of its sales – might run out of steam.

But so far this doesn’t seem to be happening. Despite all the chatter about China’s credit boom and potential bust, and Brazil’s lacklustre economy, things are still looking good for Unilever. Yes, its sales growth has slowed down a tiny bit, but sales growth during the first half of 2013 in the Far East and Africa was still 9.2%, while Latin American markets posted their eighth successive quarter of double-digit sales growth.

All in all, Unilever’s home care and personal care products are doing well. And what’s encouraging is that Unilever is selling more of its products to these customers, rather than just jacking up prices – although it is increasing these as well. It is also growing its profit margins too, proving that it isn’t winning customers at the expense of profits.

It’s true that Unilever is very vulnerable to a slowdown in emerging-market sales. Trying to make money from European and North American consumers has become a lot harder in recent years, with cash-strapped customers constantly looking for bargains. If companies don’t offer discounts from time to time, shoppers are likely to switch over to supermarket own-label products in order to save money. But while nobody really knows what the growth rate of profits will be over the next ten years, there’s a good chance that more people will be buying Unilever products at a higher price than today.

Should you buy the shares?

In any case, Unilever is exactly the type of company that warrants a place in most portfolios: it is good at making money year in, year out. If you look at the hallmarks of a quality company, it ticks a lot of boxes. Return on capital employed (ROCE) is a healthy 20%, while the company generates plenty of surplus cash flow, which has been used to boost its dividend payments. This makes Unilever a great investment – at the right price.

In May, at 2,900p, the shares traded on over 21 times 2013 projected earnings, which was arguably a bit toppy. Today they trade on 18 times. That makes the shares more expensive than Reckitt Benckiser, cheaper than Colgate-Palmolive and about the same as Procter & Gamble. But it’s hard to argue that any of these shares are cheap right now, with earnings only expected to grow by 5%-6% in 2013. Unilever offers a decent dividend yield of 3.6%, which should grow, but I think that investors are paying just a little too much for its quality at the moment. It’s one for your watch list.

Verdict: add to your watchlist

Unilever (LSE: ULVR)

Share price: 2,479p

Market cap: £73.0bn

Net assets (June 2013): €13.3bn

Net cash (June 2013): €11.6bn

P/e (current year estimate): 18.1 times

Yield (prospective): 3.6%

Interest cover: 13.4 times

Dividend cover: 1.5 times

What the analysts say

Buy: 11

Hold: 9

Sell: 3

Target price: 2,810p

Directors’ shareholdings

P Polman (CEO): 250,003

J M Huet (CFO): 76,626

M Treschow (chair): 15,000