The shares are pricing in a profits boost that may not materialise, says Phil Oakley.

Once the undisputed king of the British high street, it’s been a long time since all seemed well at Marks & Spencer. Fifteen years ago it had just become the first British retailer to make £1bn in annual profits and the future seemed bright. Investors probably thought it could make another billion over the next decade. Instead, the company went off the rails, having lost touch with its customers.

M&S made £1bn in profits again in 2008, but seems to have struggled ever since. Plenty of people have tried to fix the business with varying degrees of success. None has been able to return it to stable prosperity though. Profits have stagnated and are expected to be just £670m this year. Dividends have been cut and have not grown for three years. Marc Bolland, a marketing maestro who worked wonders at supermarket Morrisons, was supposed to turn things around. However, the business has seen little in return for his efforts and the large amounts of money spent on improving it.

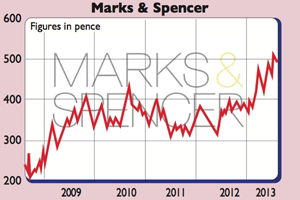

Nevertheless, looking at M&S’s share price, you wouldn’t think this was the case. It is up by nearly 40% over the last year. You now have to pay more than 15 times next year’s earnings for the shares, compared with the ten times you could have picked them up for a couple of years ago. So is the market right and will Bolland succeed where others have failed? Or is it time to check out?

What has M&S done wrong?

If the analysts’ forecasts are to be believed (always take them with a pinch of salt), then M&S will see its profits growing strongly from 2014 onwards. All the billions it will have spent on improving the business will have been worth it.

And there’s no doubt that M&S needed to invest. A lot of its stores had become tired, uninspiring places to shop, and needed cheering up. The business was also overly complicated, especially its supply chain, which led to problems getting enough products at competitive prices into stores. M&S doesn’t make as much money on its clothes as the likes of rival Next, and the improvements it is making could see it get a bigger bang for its buck. A big new warehouse will also help it to grow its online sales.

It has been expanding abroad with new stores and websites, into places such as China, India and the Middle East. These have done quite well, but problems in Europe and extra costs saw international profits fall by 10% last year. From next year, though, investment will be scaled back, which should see M&S generating more surplus cash flows. But will sales and profits start to grow again and justify the money spent?

M&S has become very good at selling high-quality food in Britain, where it is the market leader. It should continue to do well here, especially if the economy recovers. However, it still doesn’t sell food over the internet and arguably needs to start doing this if it wants to grow faster.

A difficult market

For a long time, M&S’s problem has been selling clothes and homewares, which account for 45% of its UK sales and a big chunk of profits. M&S has been struggling for a long time to get its clothing ranges right. Sales have been falling for the last two years and its market share has been falling. All its investment and productivity improvements are no good if it isn’t selling stuff that customers want to buy.

It’s difficult for M&S to please everyone at the same time. For example, it’s hard to put together ranges of clothes for its core middle-aged customer base while also trying to woo younger shoppers. The likes of Next, John Lewis and Debenhams have been eating M&S’s lunch here, while retailers such as Primark have proved a hit with people looking for a bargain.

Fashion retail is ferociously competitive, with lots of sales and offers needed to shift stock. The internet has also made life very tough for high-street retailers like M&S. This can make profits move wildly up and down from one year to the next.

What to do with the shares now

Despite its challenges, M&S is not a terrible business. It makes higher returns on its assets than the major supermarkets do, but there always seems to be the feeling that it could – and should – be doing a lot better than it is. Perhaps someone will take it over? Philip Green has tried to buy M&S twice, while private-equity buyers might look at the value of its property portfolio. It should probably concentrate more on what it is good at, selling food, but whether there’s enough people who could afford to buy their weekly groceries at M&S remains to be seen.

Also, lots of its high-street stores are not suited to shifting trolley loads of food from them. Management is running out of time to boost profits. As long as clothes make up a large part of the business, it’s difficult to see profits growing and becoming stable enough to make M&S a better company. With the shares pricing in a decent improvement, M&S shares look no better than a hold at current levels. It might be time to take some profits.

Verdict: take profits

Marks & Spencer (LSE: MKS)

Share price: 493p

Market cap: £8.0bn

Net assets (March 2013): £2.5bn

Net debt (March 2013): £2.6bn

P/e (current year estimate): 15.3 times

Yield (prospective): 3.5%

Interest cover: 6.0 times

Dividend cover: 1.9 times

Directors’ shareholdings

M Bolland (CEO): 495,290

A Stewart (CFO): 51,622

R Swannell (chair): 100,000

What the analysts say

Buy: 12

Hold: 10

Sell: 9

Target price: 462p