The US dollar has fallen by 8% since July.

The Federal Reserve’s decision to delay any slowdown in its money-printing has hit the US currency hard. And with America on the verge of defaulting on its debt, prospects look bleak.

Yet, in the longer run, a rising dollar looks like a good bet. In fact, it almost looks inevitable.

And you can profit from that rise without taking ridiculous amounts of risk. Here’s how…

Why a stronger dollar is only a matter of time

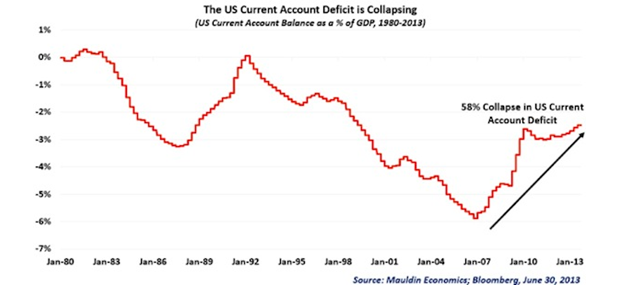

So why is a rising dollar practically inevitable? It comes down to what’s happening to America’s long-standing current account deficit – it’s collapsing.

In other words, the gap between what the US imports, and what it exports, is narrowing fast.

You can see what’s happened to it over the past 30 years in the chart below.

Source: Mauldin Economics.

The red line shows the current account deficit as a percentage of GDP.

Back in 1980, the US had no current account deficit at all. Effectively imports and exports of goods and services were in balance. (It involves some other payments too, but in essence, this is what it boils down to.)

You can see on the chart that the current account deficit exploded to almost 6% of GDP by 2007, which you could argue was unsustainably large. It meant that America was importing many more goods and services than it sold abroad – living beyond its means.

However, the trade balance has improved sharply since then. It’s now almost down to 2% of GDP. Why the big shift? It’s all down to the shale gas revolution.

Firstly, the fact that the US is producing much more of its own gas (and oil) means that it has to import less energy. That’s great news for the current account.

Secondly, shale gas has sent energy costs in the US plummeting. This cheaper energy makes it easier for American businesses to compete against overseas rivals.

This in turn has led to the phenomenon of ‘re-shoring.’ This is where a US company brings some or all of its manufacturing business back to the US, from an emerging economy such as China.

This is driven partly by the availability of cheaper energy, but it’s also a response to higher wages in some emerging markets. What’s more, new technologies mean that manufacturing is becoming more flexible and less labour-intensive, which again is good news for the US. Cheap labour is the main reason for offshoring. If labour becomes a less important part of the equation, then there’s no reason to go overseas.

Indeed the outlook is so positive that analyst John Mauldin thinks Mauldin Economics, which would be pretty remarkable.

And as I’ve said, an improved trade balance is good news for the dollar. If the trade deficit is lower, the US will need to spend fewer dollars overseas. All things being equal, this should push up the dollar’s value.

How to profit from a stronger dollar

So how you can make money from a stronger dollar?

Well, the high-risk option is to use spread betting to bet that the dollar will rise against the pound or the euro. If you are interested in spread betting, sign up for my colleague John C Burford’s free MoneyWeek Trader email.

However, spread betting is only for short-term trades – and it’s very hard to say what could happen to the dollar in the next few weeks. With the shutdown and the debt ceiling hanging over everything, anything could happen.

This is more of a trend for the long-term. Another option is to look at the ETFS Short GBP Long USD (LSE: USD2) exchange traded fund (or strictly speaking, ‘exchange traded currency.’) Broadly speaking, this product should rise when the pound falls against the dollar, and fall when the pound is rising.

However, do bear in mind that the fund is ‘synthetic’ and uses derivatives to track the dollar. That means there’s a small counterparty risk where investors would lose out if derivatives providers were unable to meet their obligations to the long-dollar fund. You also need to keep a close eye on its performance – it may not be as short-term as a spread bet, but it’s not a ‘buy and hold’ investment either.

Another option is to invest in US shares. However, I’d be a bit wary there, as overall US share valuations look a little high right now – and they could fall sharply if the debt ceiling problem doesn’t get solved.

So your final option is to invest in UK-listed companies that do a lot of business in the US. Intercontinental Hotels (LSE: IHG) is a good example – 80% of its profits are generated in the US. Or you could buy drugs giant GlaxoSmithKline (LSE: GSK) which generates a third of its revenue in America (I own shares in Glaxo myself).

Both companies are doing well in the US, and if the dollar rises, that will feed through into higher profits and dividends for UK shareholders. Buying shares in both companies strikes me as a sensible way to gain long-term exposure to the rising dollar.

• This article is taken from our free daily investment email, Money Morning. Sign up to Money Morning here.

Our recommended articles for today

Simple solutions for lazy investors

When it comes to investing, most people don’t want to have to think too much about it. They want a simple ‘one-stop’ solution. Merryn Somerset Webb suggests a few.

It’s a great time to buy this controversial commodity

Palm oil is a controversial industry. But for long-term investors, now looks like a good time to buy in. Lars Henriksson explains why, and picks seven stocks to consider.