The shares are doing well, but profits may be drying up, says Phil Oakley.

Arthur Guinness paved the way for today’s Diageo when he opened a brewery in Dublin in 1759. Over 200 years later, the merger of Guinness and Grand Metropolitan in 1997 to form Diageo was meant to create a drinks giant that would do great things for its shareholders.

For over a decade it failed to do so. It started out as an unfocused conglomerate that owned Burger King restaurants and the Pillsbury baking products business as well as many spirits brands. It bought up other drinks firms, such as Seagram, but the City was often underwhelmed with its performance.

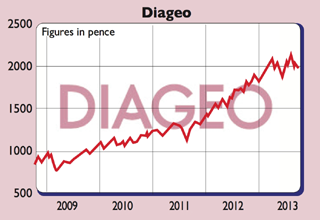

During the last two years, though, Diageo has been a terrific investment. The share price has soared as the firm set itself ambitious sales and profit growth targets that it has so far managed to meet. It has also benefited from investors’ appetite for the dependable, growing profits of consumer goods firms since the financial crisis. For some time this has made Diageo look more expensive to buy compared with its profits and dividends.

Buying good-quality firms at reasonable prices is usually a good way to make money over the long haul. But are investors being asked to pay too much and can it keep it profits growing?

How the business is doing

Diageo has a lot going for it. Consumers tend to like the security that comes with buying branded goods. It is the world’s leading premium drinks business with top selling brands such as Johnnie Walker, Smirnoff, Baileys, Tanqueray Gin and Guinness.

It is underpinned by its market-leading position in America – the world’s biggest spirits market. This is its biggest business, but it’s rapidly being caught up by its emergingmarkets side, which is growing strongly.

In America and the healthier economies of western Europe, Diageo has been good at getting customers to buy more expensive spirits, despite the fact that they are not drinking more. It has spent money developing and marketing super and ultra premium whiskies, gin and liqueurs. This has meant higher sales and bigger profit margins.

The real profit growth is coming from emerging markets. As these grow, more people are moving into the middle class and developing a taste for the good things in life. In eastern Europe, Turkey, China and southeast Asia demand for Diageo’s spirits is soaring. In Africa, where it is bullish about its prospects, consumers are drinking more premium beers.

Diageo has also bought up local drinks firms. This will take time to pay off. But if you believe growth of the emerging markets’ middle class has further to go, then the prospects could be good indeed.

But it’s not all plain sailing. Southern Europe and Ireland remain tough, with people not buying as many premium spirits brands as they were a few years ago.

All is not well in Asia-Pacific either, where there was no sales growth at all during the second half of Diageo’s last financial year due to weakness in Korea. With the Chinese government cracking down on lavish entertainment and Unilever warning that emerging-markets growth is slowing, some fear the future may not be as rosy.

What to do with the shares now

On the key measure of return on capital employed (ROCE), Diageo makes just under 20% on the money it has invested. That’s good, but not as good as Unilever or Reckitt Benckiser, which trade at similar or lower earnings multiples. Diageo’s returns are driven by profit margin improvements, which is fine, but it’s getting less sales for each £1 it invests (a falling asset turnover ratio). This may improve as recent investments mature or could mean returns will fall. Plus, at over 17 times next year’s earnings, the shares aren’t cheap and the prospective 2.7% yield is uninspiring.

More focused on profits growth, the City still expects Diageo to grow earnings and dividends per share by 9%-10% for the next two years. So many analysts are telling fund managers to buy the shares. A growing dividend is welcome but investors should concentrate on total returns (the sum of dividends received and the changes in the share price). You will only make money on Diageo shares if investors will still pay the punchy price/earnings (p/e) ratio in the future.

With low interest rates (a key factor behind high p/e ratios) across the world likely to rise, combined with the risks of an emerging-markets slowdown, there’s a good chance this won’t happen. Diageo is a good firm, but we’d steer clear of the shares for now.

Verdict: one for the watchlist

Directors’ shareholdings

I Menezes (CEO): 599,561

D Mahlan (CFO): 227,638

F Humer (chair): 48,767

What the analysts say

Buy: 22

Hold: 12

Sell: 0

Target price: 2,225p

Key facts

Stockmarket code: LSE: DGE

Share price: 1,943p

Market cap: £48.8bn

Net assets (June 2013): £8.1bn

Net debt (June 2013): £8.8bn

P/e (current year estimate): 17.3 times

Yield (prospective): 2.7%

Interest cover: 7.0 times

Dividend cover: 2.1 times