If you agree that developed markets have “regained the fire in their belly and are set to storm ahead” of emerging markets over the next 12 months, writes Kate Morley in the Investors Chronicle, the Brunner Investment Trust (LSE: BUT) may be worth investigating.

Established by the Brunner family in 1927, the trust has a 40-year record of dividend growth. Two managers split responsibility for UK and global equities. On the UK side is Jeremy Thomas, with 17 years’ experience under his belt, while Lucy Macdonald, who has 20 years’ equity experience, takes care of the global side.

Just 8% of the fund is in emerging markets (with 1% in Latin America and the rest in the Asia Pacific region), according to Trustnet. It is 44.6% invested in Britain, with 21.4% in North America and 11.6% in European equities.

With “signs of better economic activity” in the developed world, the pair think Europe could “see at least a stabilisation in growth momentum in the second half of the year”, while “US growth could surprise on the upside”, as long as political agreement is reached on its debt ceiling .

Thomas favours financial equities, with a 20% weighting in stocks in the sector, such as HSBC. The trust has benefited particulary from a strong performance in mid-cap financials, such as Tullet Prebon and Resolution, says Morley.

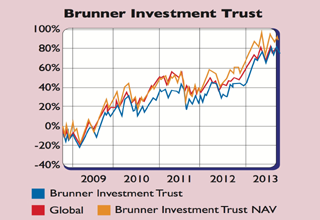

Thomas plans to raise his exposure and buy more banking stocks this year. It has delivered a return of 25.6% over one year and 44.6% over three years. Trading at a 14% discount, and with an ongoing charge of 0.81%, it looks a reasonably cheap way to boost exposure to developed markets.

Contact: 0800-389 4696.

Brunner Investment Trust top ten holdings

| Name of holding | % of assets |

| Royal Dutch Shell | 3.30% |

| GlaxoSmithKline | 3.10% |

| HSBC | 3.10% |

| BP | 2.80% |

| Vodafone | 2.70% |

| Reed Elsevier | 2.00% |

| UBM | 1.50% |

| Tesco | 1.40% |

| Rio Tinto | 1.40% |

| AbbVie Inc | 1.40% |