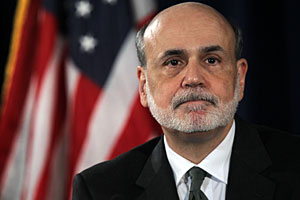

Tomorrow we get the Federal Reserve’s next decision on interest rates.

Investors have been given a temporary reprieve. US government shenanigans have given the Fed every excuse it needs to hold off any hint of tighter monetary policy until well into next year.

But the question remains – how long can the Fed stay on hold? One way or another, interest rates are now about as low as they can go.

That’s left bonds – with their fixed income payouts – looking very expensive indeed.

But they’re not the only investment under threat…

Why higher interest rates are bad for bonds

Neil Woodford’s decision to leave Invesco Perpetual next year could be the most significant news of the year. And not just because he’s one of the only British fund managers who is recognisable to most people by name alone.

It may also be telling us something important about the sector Woodford is famous for operating in – equity income.

Here’s the problem. Since the financial crisis, interest rates on government bonds have gone lower than almost anyone thought possible, aided by central bank money-printing. In turn, that’s dragged down the yields on almost every other asset.

If a US government bond – which is meant to be ‘risk-free’ – pays you 5%, then you’re going to want more to invest in anything riskier. You might want 7%, say, to invest in a corporate bond, or more to invest in a really risky one – a junk bond.

But if a US government bond pays just 3%, then you’ll want correspondingly less. And if you believe that the yield on the US government bond is going to go even lower, then you’ll be keen to lock in the higher rates while you still can.

So in a world where interest rates are falling, income-paying investments will do well. People become willing to pay more for a given amount of income. As the price rises, the yield falls.

And as long as this is expected to continue, people will happily keep buying, in the belief that today’s yield – while low – is at least likely to be higher than tomorrow’s.

The problem is – what happens when that process goes into reverse?

Higher rates could hurt income stocks too

You see, one way or another, interest rates are about as low as they can go. Central bank official rates are near zero in most major countries. As a result, investors have chased yields into the dirt.

And now, “nothing in fixed income is cheap,” as Rick Rieder, BlackRock’s chief investment officer for fixed income, told a UBS Wealth Management conference last week.

Yes, the Fed may have granted investors a reprieve. But it merely postpones the threat of rising rates, it doesn’t do away with it. In fact, even if the Fed chooses to keep printing money and forget about tapering altogether, the problem remains.

If monetary policy stays at emergency levels, then it makes it more likely that inflation will return. That in turn will also see investors demand higher yields – because they need a return that beats inflation. So one way or another, it’s hard to see how interest rates can get any lower than they are now.

In turn, that suggests that the virtuous cycle will at some point turn vicious. Investors who expect higher interest rates will demand higher yields to compensate. The only way to get higher yields on fixed-income bonds is for prices to fall.

But bonds aren’t the only asset at risk. The equity income sector – particularly big blue-chips that are almost like bonds in terms of their strong balance sheets and reliable dividend payouts – have become particularly popular in recent years.

It makes sense. Rattled investors looking for income are going to gravitate to the ‘safest’ part of the stock universe.

But if these income funds and stocks are being bought as substitutes for bonds, then they’re also going to take a hit when interest rates rise, and it becomes easier to get a good income elsewhere.

What can you buy instead of income stocks?

This concern about rising rates might be at the back of Woodford’s mind.

It’s certainly worrying another very successful manager – Jacob de Tusch-Lec of the Artemis Global Income fund. His fund was the top-performing global equity income fund in the past year.

He tells FT Adviser: “In a world where government bond yields are 4%, equity income comes under pressure… It will be difficult because suddenly a number of dividend yields do not seem that high… high interest rates could be the moment when global income needs to have a bit of a rethink.”

And while no one knows exactly when rates will rise, the “direction of travel is clear” – it’s up. As a result, he’s cutting back on ‘bond-style’ stocks such as real estate investment trusts and utilities.

We’ve been big fans of dividend-paying blue chips in recent years, and they’ve done very well. However, all good things come to an end.

I’m not going to suggest you dump all your income investments right now. But you should be preparing to shift the focus of your portfolio away from pure income, and towards those that can promise growth too. We’ll be looking at ways to invest in this theme in the next issue of MoneyWeek magazine, out on Friday. If you’re not already a subscriber, get your first three issues free.

• This article is taken from our free daily investment email, Money Morning. Sign up to Money Morning here.

Our recommended articles for today

George Osborne’s plan to cheer you up

Nothing makes voters happier than rising house prices, says Bengt Saelensminde. And the government knows this only too well.

The writing’s on the wall, but the bulls don’t want to know

There are asset bubbles all over the place. But don’t make the mistake of thinking the global economy is fixed, says Merryn Somerset Webb. Things are far from fixed.