Gold investors often look at the relationship between the price of gold and the price of oil. The theory behind this is that there is a strong relationship between the two commodities.

The oil price is seen as a major driver of inflation in an economy (oil is a key raw material, so if its price rises then the price of almost everything else will be affected too).

In turn, gold is seen as a good hedge against rising or very high inflation, so rising oil prices should in theory boost the price of gold too.

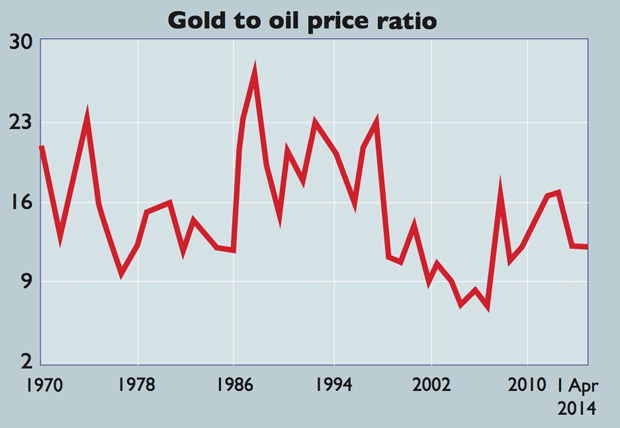

When the ratio of gold prices to oil prices is high, gold is viewed as expensive relative to oil as it was in the mid-1980s and the late 1990s.

The average ratio since 1970 is just over 15 compared with 12.4 times now, suggesting that gold may be a little on the cheap side compared to oil (as measured by the West Texas Intermediate (WTI) benchmark) – though that could equally be corrected by the oil price falling rather than gold rising.