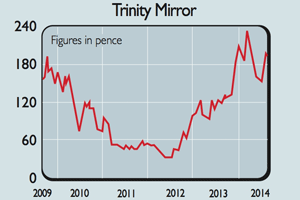

In November 2012, I tipped this newspaper stock as a potential recovery play. At 79p each, the company’s shares were trading on a forward price-to-earnings (p/e) ratio of just 2.9 times, giving it a market value of just over £200m.

It had debts of £162m and a hole in its pension fund to the tune of £283m. It looked as though the market was pricing the shares for bankruptcy. Yet the firm was still producing lots of cash flow.

It had a new CEO, Simon Fox, who planned to cut costs and get its newspapers on to digital platforms. I thought at the time that if he was able to achieve this, then there was a good chance the cash would keep rolling in.

Fast forward to today and Fox seems to have done a pretty good job. The share price has soared to 212p and debt is down to £56m. Things have improved so much that it’s even going to start paying dividends again. If you bought back in 2012, you should have made some big profits by now. So should you bank them? Or hope for more?

Trinity Mirror (LSE: TNI) still has a lot of problems. Sales of its key titles – the Daily Mirror, Sunday Mirror, the Sunday People and the Daily Record – are still falling, as are sales of its regional titles.

On the more positive side, both Mirror titles are growing their share of the print advertising market, and higher cover prices and cost cutting have helped to limit the fall in revenues.

Digital revenues grew by 47% in the first six months of 2014, although these remain a very small part of the overall business. There’s more cost-cutting to come, and the price of newsprint has been falling, which should help profits this year.

But with so much of the company’s profits still coming from declining print titles, working out what its sustainable profits are is quite tricky. In 2012, this didn’t matter so much – there was a big ‘margin of safety’ for any buyer of the shares, because the price was so low.

But I’m not so sure now. The pension fund deficit has remained stubbornly high at £272m and £36m of cash will have to be ploughed into it for the foreseeable future in order to get it back on an even keel.

During the last year Trinity Mirror produced operating profits of £105.6m. Its enterprise value (market value plus debt and pension-fund deficit) is £876m, giving it an earnings yield of 12%.

If profits can be kept at this level, a case can be made for saying the shares are still cheap. But cost-cutting can only go so far, and with newspaper circulation still falling, maintaining profits is by no means going to be easy.

So if you have made big gains from this share, you might want to take some money off

the table. It’s going to be a lot harder to make money from here.

Verdict: take profits