I tipped children’s goods retailer Mothercare (LSE:MTC) as a risky but potentially good value turnaround story back in May. So far the company looks as though it is making good progress at getting its house in order. It has raised just under £100m from its shareholders in a recent rights issue and it looks as though it has a sensible plan to get its troublesome UK business turned around from making losses and back into profit.The good news is that last week’s half-year results gave some further grounds for cautious optimism.

Same-store sales (which exclude new store openings to make a meaningful year-on-year comparison of sales growth) in the UK have started to grow again. Admittedly the business has been up against soft comparisons from the year before, but getting sales to grow again, even from a relatively low base, is a creditable result.

The company has also taken the bold decision to stop discounting its products. This has led to very volatile sales from week to week, but holding firm and selling more goods at their full price has stabilised profit margins after five years in decline, and reduced the trading loss compared with last year. Of course, avoiding promotional sales only works if the product quality is high. It seems that Mothercare is making some progress on this front, but it’s too early to tell if this strategy will ultimately succeed.

The company is also getting on with closing troublesome stores and is seeing some improvements in moving a large chunk of its UK sales onto the internet. Online sales grew by 14.1% between March and September. A lot more work is needed here, but the progress is encouraging.

The bulk of the value in Mothercare, however, rests with its overseas business. This continues to do well, with same-store sales up by 4.9%. The strength of the pound meant that trading profits were unchanged year on year, but there is still lots of scope for growth in this business, while the fact that the pound has grown weaker in recent weeks should help profits to keep rising in the years ahead.

Should you buy the shares?

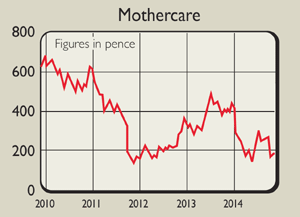

The investment case for Mothercare remains unchanged. If the UK business can get back to break-even or even make a small profit while the international business keeps growing, then the shares are still worth backing. Current multiples of earnings are not really meaningful. On its own the international business could be worth £500m on a good day. If so, then a debt-free Mothercare without the UK losses is comfortably worth more than 200p per share.

Verdict: still a buy