What happened?

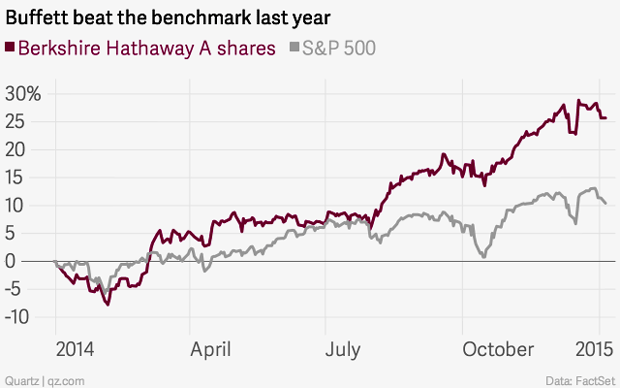

Warren Buffett’s holdings giant Berkshire Hathaway (BRK/A:US) performed more than twice as well as the S&P 500 index last year, growing in value by 27.25%. As of 5 January, the company was trading at an all-time high.

Chart source: Quartz

How did Buffett do it?

Buffett’s investment vehicle, Berkshire Hathaway, has changed the weighting of its portfolio, shifting its focus from equities to company acquisitions.

“Not too long ago, Berkshire was seen as a way to buy into the billionaire’s skill picking stocks”, said Bloomberg. “These days, it’s primarily a bet on his ability to make acquisitions and distribute funds among the dozens of businesses he bought over the past five decades.”

These hard assets really worked for Buffett in 2014. Profit from the BNSF railroad rose about 5 percent to $1.035bn, while Berkshire Hathaway’s holdings in utilities and energy, saw profits rise from $472 m to $697m.

“There are some line items in here that just scream operating success,” said Bill Smead, chief investment officer of Smead Capital Management in Seattle.

Buffett’s successful investment in large cap companies meant major mistakes – among them a $678m loss on Tesco (down 43.47% in 2014) and a pounding for IBM (down 14%) – didn’t dent performance. Some of Buffett’s equity holdings performed phenomenally. Wells Fargo – Berkshire Hathaway’s largest holding – rose 21% last year. Gains on successful equities and hard investments were enough to absorb losses elsewhere.

Chart source: Quartz

What next for Berkshire Hathaway?

Buffett is synonymous with Berkshire Hathaway. So what happens when he passes the torch?

The company’s move towards company acquisition is designed in large part to bulletproof its performance in a post-Buffett world. Berkshire Hathaway’s enormous cash reserves – currently over $63.2bn – have encouraged investors, who believe the company will continue to buy hard assets in 2015.

“It would come as no surprise to see some kind of significant acquisition or investment in the near future”, said Nasdaq.

“The question is: Where?”