An inflation-linked bond (often referred to as a “linker”) is a bond whose payments are indexed to the rate of inflation. The way in which this works varies between bonds, but let’s take a simplified example.

Assume we have a ten-year bond with a “coupon” (interest rate) of 2.5%, which is paid yearly, and a “principal” (the amount repaid at maturity) of £100. Let’s also assume that cumulative inflation totals 25% by year five of the bond’s life and 50% by the time it matures. Then the regular coupon payments will rise in line with inflation: the first will be around £2.5 (£100×2.5%), the one at the end of year five will be around £3.125 (£100×125%×2.5%), and the last payment in year ten will be around £3.75 (£100×150%×2.5%). When the bond matures, the investor will receive a principal payment of £150 (£100×150%).

Most inflation-linked bonds are issued by governments and the biggest markets are for US Treasury inflation-protected securities (Tips) and UK index-linked gilts. The main difference between UK linkers and Tips is that Tips offer deflation protection – the principal can’t fall below its initial value. If you buy $100 of Tips and £100 of UK linkers and we see deflation of 10%, you would get back $100 in Tips but £90 in UK gilts.

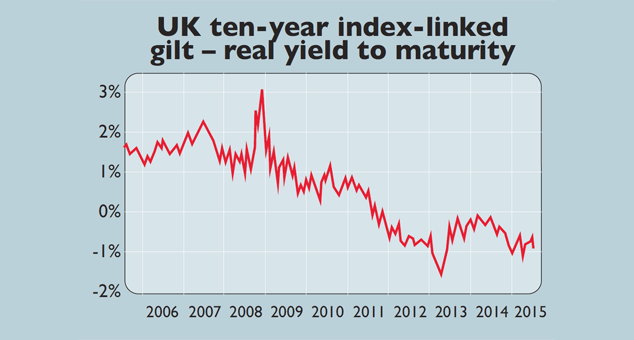

That’s the basic principles of inflation-linked bonds. But how do they look as an investment today? There’s no doubt they are expensive by past standards – they are priced to lose money in real (inflation-adjusted) terms if held to maturity. The UK index-linked gilt maturing in March 2014 has a real yield to maturity of -0.87% (see chart). This is partly due to investors such as pension schemes, who have long-term inflation-linked liabilities and keep buying linkers to hedge these.

However, we can’t look at inflation-linked bonds in isolation. They need to be compared to similar conventional bonds. Yields on these are also low, and unlike linkers they offer no protection against the rising cost of living. So if inflation exceeds a certain level, linkers could still prove a better choice for bond investors, because they would lose less money in real terms. We measure this by looking at the “breakeven rate”, which is the rate of inflation at which the returns from conventional bonds and linkers would be the same. For ten-year UK government bonds, this is now 2.7%. But UK linkers are indexed to the older retail price index (RPI) instead of the newer consumer price index (CPI). RPI usually averages a bit over 1% more than CPI, so if you believe that inflation over the next ten years will average more than around 1.5% on the CPI measure, linkers could be a better bet than conventional bonds.

That actually seems quite likely, but there are still concerns. First, you need to trust official statistics – many people feel they understate inflation. Second, because most UK linkers mature far in the future, a typical index-linked gilt fund has a very high “duration” – which essentially means that the market value of the bonds it holds could drop significantly if interest rates rise sharply. Thirdly, if you plan to hold the bonds to maturity, you are still locking in a negative real return – you’re just betting they will do better than conventional bonds because of inflation.

Overall, our view is that you may want to hold government bonds as a “safe haven” – they should perform well during a crisis. Linkers could make up part of that, as a hedge against inflation. But other than that, we think they are not attractive at present, just like conventional bonds.