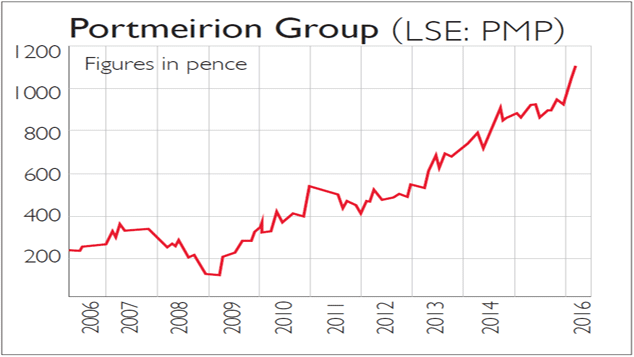

Plates and saucers are flying at pottery firm Portmeirion (LSE: PMP). The firm is listed on Aim and is now leading a renaissance for Britain’s once-dominant ceramics industry, reporting seven consecutive years of record growth.

Portmeirion, founded in 1960 and named after the idyllic Welsh village, bought two of the UK’s best-known ceramics brands, Spode and Royal Worcester, in the downturn of 2009. Since then the shares have taken off, as consumers in America and Asia have gone crazy for its growing range of dainty patterned ceramics.

Portmeirion makes porcelain, bone china and earthenware goods at its factory in Stoke-on-Trent. It recently spent £1.5m on a new kiln and is turning out 170,000 pieces per week, double its production levels in 2009. It has a showroom on Madison Avenue in New York and sells more in America than in the UK.

The company’s floral designs are also a big hit in Asia, with sales rocketing in India and China. South Korea is another big buyer, accounting for a quarter of the business. Total revenue jumped 12% last year to £69m, with full-year profit of £8.6m. Online orders are growing even more rapidly, up 27% last year to £2.5m. And sales for the current year are already up, according to a recent statement.

Portmeirion makes 80% of its pieces in England, but some are also made in China. That caused problems in 2013, when the EU introduced swingeing new anti-dumping taxes on ceramics imported from the country, forcing Portmeirion to shift part of its production to Bangladesh. Despite the added cost of more than £400,000, it still ended the year with a record profit.English bric-a-brac is in right now (think Downton Abbey and The Great British Bake Off).

That could change and consumers in the US and Korea might follow a different fad, stalling Portmeirion’s growth rate. Its shares are trading at 16 times earnings and a 2.7% dividend yield, pricing in much of the good news.

But on both counts, Portmeirion is still cheaper than Churchill China, its closest listed competitor, which turns over less each year. Portmeirion’s profit margins are higher and it is also debt-free, with £11.1m in cash on the balance sheet. It is difficult to find a crack in the company.

The best tips from the financial press

Three stocks to buy

Chemring

Investors Chronicle

Defence group Chemring makes bullets, military flares and decoys. A run of profit warnings, a cut to its dividend and an £81m rights issue mean investors have rightly “lost faith”. But the company’s balance sheet has been strengthened, defence budgets are once again increasing and the company has been shortlisted for US contracts. A large, long-awaited agreement in the Middle East also seems to have come good.

Reckitt Benckiser

Shares Magazine

Consumer drugs group Reckitt Benckiser owns Nurofen, Strepsils and a host of cleaning products, including Dettol. It has been a strong performer and does not come cheap at 27 times earnings. But the growth rating is justified. Reckitt could double its sales in the next ten years as new product lines come through its pipeline. In uncertain times, it is “reassuringly expensive”.

Ted Baker

The Times

Retail sales at the menswear group rose 13.5% last year, while wholesale figures were even more impressive, up by a third. Ted Baker’s quirky style, floral designs and international store opening programme is winning over new shoppers. American sales remain strong and founder Ray Kelvin is sitting on a strong brand.

Three stocks to sell

Genel Energy

The Daily Telegraph

Shares in oil hopeful Genel have nose dived, falling by 40% last month after the company revealed that its Tak Tak oil field in northern Iraq is only a third of the size previously estimated. Returns have been “dismal” and the company is an obvious “value trap”, says The Daily Telegraph. It’s wise to stay well away.

JD Wetherspoon

Shares Magazine

Margins have been hit at pub group JD Wetherspoon, after the government hiked the minimum wage. On top of the extra cost, management has continued to chase sales growth by offering discounted deals, trimming margins further. As such, Wetherspoon’s profitability is falling faster than rivals.

French Connection

The Daily Telegraph

Losses at the fashion retailer have jumped fivefold to £4.7m. It has lagged rivals in moving online, with three-quarters of its sales coming from its own stores, leaving the company vulnerable to shifting consumer habits. French Connection is also sitting on high levels of inventory, making it a risky bet.

And the rest

.basic-table {

border-spacing: 0px;

border-collapse: collapse;

border: 1px solid #a6a6c9;

font-family: Calibri, Verdana, Helvetica, sans-serif;

font-size: 1em;

color: #000000;

width: 100%;

}

/* same as basic-table but with smaller font */

.basic-table-small {

border-spacing: 0px;

border: 1px solid #a6a6c9;

font-family: Calibri, Verdana, Helvetica, sans-serif;

font-size: 0.8em;

color: #000000;

width: 100%;

}

/*table with no border – use btfirst for leftmost cells */

.noborder {

border-spacing: 0px;

border-collapse: collapse;

border: 0;

font-family: Calibri, Verdana, Helvetica, sans-serif;

font-size: 1em;

color: #000000;

width: 100%;

}

/* headers */

th.bth, th.headnorm {

background: #2b1083;

padding: 3px 3px;

border-left: 1px solid #a6a6c9;

border-bottom: 0;

border-right: 0;

border-top: 0;

color: white;

font-weight: bold;

text-align: center;

}

/* normal cells – left aligned, and centered */

.btfirst {

padding: 3px 3px;

border: 0;

vertical-align: center;

text-align: left;

}

td.btleft {

padding: 3px 3px;

border-left: 1px solid #a6a6c9;

border-right: 0;

border-top: 0;

border-bottom: 0;

vertical-align: center;

text-align: left;

}

td.btcenter {

padding: 3px 3px;

border-left: 1px solid #a6a6c9;

border-right: 0;

border-top: 0;

border-bottom: 0;

vertical-align: center;

text-align: center;

}

/* row shading */

tr:nth-child(even) {

background: #ffffff;

}

tr:nth-child(odd) {

background-color: #E1E8F4;}

}

/* “naked” version (no vertical border and bigger, serif font) */

.basic-table-naked {

border-spacing: 0px;

border: 0px;

font-family: font-family: Georgia, Times, ‘Times New Roman’, serif;;

color: #000000;

width: 100%;

}

th.bth-naked {

background: #fff;

padding: 8px 3px;

border: 0px;

font-size: 1.1em;

font-weight: bold;

text-align: left;

vertical-align: center;

}

td.btleftnaked {

padding: 3px 3px;

border: 0px;

vertical-align: center;

font-size: 1.1em;

text-align: left;

}

td.btcenternaked {

padding: 3px 3px;

border: 0px;

vertical-align: center;

font-size: 1.1em;

text-align: center;

}

| Buys | |

|---|---|

| BAE Systems | BAE will benefit from a new $80bn bomber project (Shares), 494p |

| Cape | The order book is up and the shares yield 6% (Times), 242p |

| FDM | Software firm FDM is growing and “flush with cash” (Shares), 540p |

| The Gym | The discount gym operator is rolling out new sites this year (Shares), 232p |

| Hochschild | Costs are falling and precious metal prices are rising (Investors Chronicle), 89p |

| Kier | Acquisitions are paying off but the shares are cheap (The Times), 1299p |

| Smiths Group | Results were mixed but the medical business is strong (Investors Chronicle), 1072p |

| Sells | |

| Dechra Pharma | Dechra has bought a business in the US that barely breaks even (Times), 1168p |

| Gulf Keystone | The firm is weighed down by debt and interest payments (Telegraph), 9.4p |

| GW Pharma | Its shares have spiked on drug test results; that may be premature (Shares), 507p |

| Inchcape | Margins are falling; the firm’s outlook is cautious (Times), 725p |

| Spire Healthcare | CEO Rob Roger is leaving and a takeover isn’t forthcoming (Times), 349p |