This will come as a surprise to some of you. But I spent a large part of my childhood and early teens living in a bog standard suburb in the American Midwest. My mother was dating a Vietnam veteran who ran a carpet shop in a smallish town called Aurora. Nice man. We went to the baseball, did a lot of bowling and sometimes had breakfast in McDonald’s. This probably makes me one of the few UK-based financial commentators who have lived among – rather than just judged – some of the tens of millions of people who voted for Donald Trump on Tuesday.

I suspect it might also be the thing that is making me rather less hysterical about the US election result than some others appear to be – for the simple reason that when I think of Midwest America, I don’t automatically assume everyone living there is a racist dimwit. I know they aren’t. Just as those who voted for Brexit in the UK mostly knew exactly what they were voting for and voted as they did for a reason, the Americans who voted for Trump did so for a reason.

You and I might like to think that nothing would have persuaded us to vote for Trump (I do, anyway). But we don’t live in Midwest towns that have been hollowed out as manufacturing shifts to Mexico; and the UK hasn’t (so far) been confronted with the idea that it is possible for a democracy to have an elite so entrenched in a capital city that spouses can take turns at the top jobs.

The best way to view the US election result then is not as a triumph of fools or as a positive vote for a misogynist misfit, but as a rebellion against the long-term march of crony capitalism and intrusive global government. With that thought in mind, let’s try to look at the silver linings in Trump’s election.

The first is that it has really given a shock to the Western elite: the internet is finally filled with articles about how corporates, politicians and mainstream journalists need to “try harder” to understand those who don’t agree with them. That is progress in itself.

The second is that among the silly talk, Trump has some perfectly reasonable policies that it is entirely possible that he could go ahead with. His fiscal ideas – if he gets them past his fellow Republicans – could give the US stockmarket something of a boost. He has talked about cutting US corporation tax from its current 35% (high by international standards) to more like 15%, and about allowing US companies to bring home cash held abroad in a one-off amnesty taxed at 10%.

Such a cut could boost the margins of firms that had looked like they had hit a ceiling (corporate earnings in the US have been falling). An amnesty, which should have been done long ago, could free up mountains of cash for investment in the US (or failing that, more share buybacks).

Trump is also planning to splash cash across the economy, spending $1trn on infrastructure and bumping up defence spending by 10% or so – and cutting regulation across the board. You might not approve of these things, but they will produce at least short-term growth (which is why the US markets ended Wednesday in perfectly good shape) and probably some fairly significant inflation to boot (no more deflation hysteria required).

The third is that the majority of the worrying things Trump said during the campaign are likely to be toned down once he takes office. Take trade – will he back out of the North American Free Trade Agreement (Nafta) or just have a go at renegotiating bits of it? The latter looks more likely – and the trade deals he might change or abandon should be seen as less of a worry for the US than for the rest of us. Those who worry about post-Brexit trade talks in the UK constantly note that we need various economies more than they need us. No one says that about America.

But the problem is that however “not all bad” Mr Trump may be, there is still no particular reason to invest in the US for the long term. Whatever happens next, it will still be an unstable, low-growth economy beset with demographic and debt problems. The inflationary consequences of huge spending on infrastructure, combined with whopping tax cuts, will keep making going anywhere near the US bond market feel like a bad idea: the new president could even be the final trigger for the reversal of the 30-year bull market in bonds.

And US stocks are already far from cheap. They are priced for perfection in a very imperfect world – at a time when wage pressures are rising, margins are already stretched and all too many stocks are acting as bond proxies. Why hold them, if bonds are turning? US stocks are so expensive today that, according to analysts at GMO, the average annual return from large US stocks is likely to be around -3.7% a year from here.

Another asset manager Research Affiliates comes up with similarly miserable numbers: the chance of a traditional portfolio of 40% US bonds and 60% US equities making the sort return most people still expect (5%) is a miserable 0.2%. Hopeless. Still, all is not lost. GMO considers emerging markets – purely on valuation terms – to have a better chance of making positive returns. And there are still markets that look properly cheap.

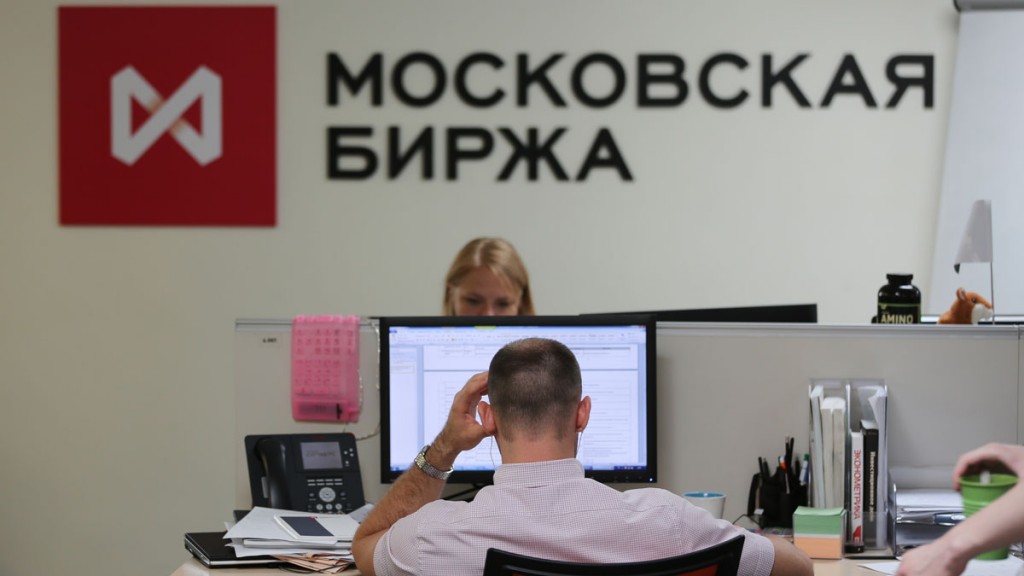

The obvious one to look at is Russia – currently trading on an average price/earnings ratio of only eight times and a cyclically adjusted p/e of just over five times (both measures are well over 20 times in the US). I’ve told you here several times that it is always worth buying bear market bottom priced markets on the basis that while you might have to wait, barring full-scale wars or communist revolutions, they usually go up in the end.

And so it is with Russia. Trump and Putin seem keen to get along. You could see this as bad news or good news – although any strategy that offers a chance of geopolitical stability is likely to appeal more to those who spent US childhoods hiding under desks in “duck and cover” nuclear drills than those who did not.

And as far as the Russian stock market is concerned it is good news: the market rose more than 2% on Wednesday. Not long now, and the JPMorgan Russian Securities investment trust I highlighted to readers in 2013 will have finally made a positive return (I hold this in my own portfolio). Investors should also stick with gold. We keep it for insurance purposes: it goes up when politics goes down. I was glad to have it in my portfolio on 24 June and on Wednesday. And I’m glad to have it there while I wait to see what happens in the Italian referendum next month, and in the French election next year. Midwestern Americans aren’t the only ones feeling fed up with overbearing governments and the march of global crony capitalism.

• This article was first published in the Financial Times