We’ve been expecting the introduction of a new wealth tax in the UK for some time. And we have been expecting it to one way or another attempt to capture the huge rise in house prices in the southeast. This isn’t easy to do – rising council taxes always cause near riot conditions in the UK, the mansion tax idea didn’t exactly fly, stamp duty is an appalling tax and pretty much at its limit already and there isn’t much appetite (except from me…) for a capital gains tax on primary homes.

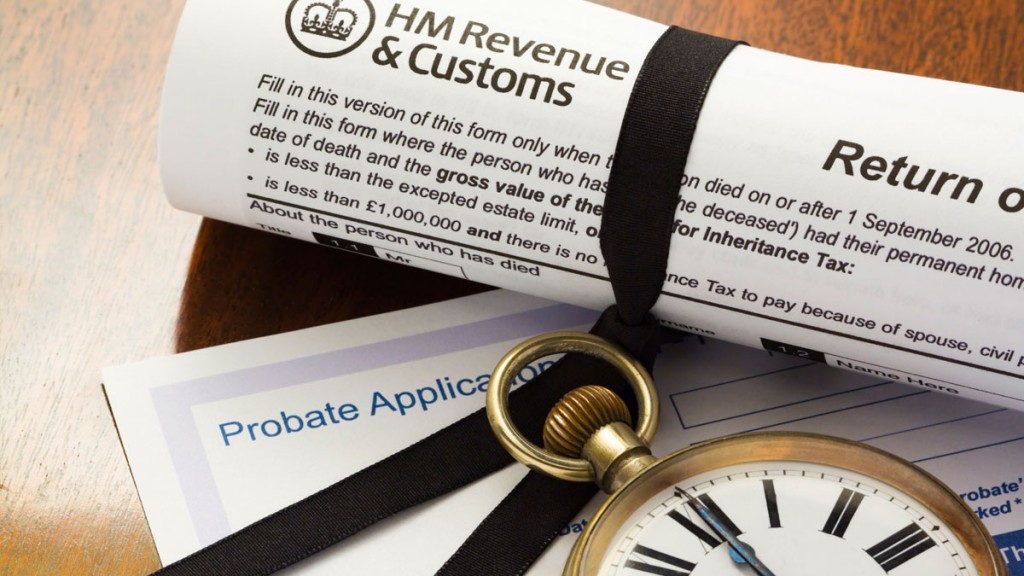

Kudos, then, to the clever clogs at the Treasury who have now come up with a new idea – one that most people won’t notice, that taxes money in limbo and that will end up raising a real amount of money (around £250m says the government – but if properly enforced I suspect it will be rather more). It is the rise in probate “fees”.

From 1 May probate fees – paid by the executors of wills and estates in England and Wales from the assets in those estates – will rise from its current level of £215 to as high as £20,000. Estates worth less than £50,000 will pay nothing. But from £50,000 the rate rises in bands until you hit £2m, after which all estates pay £20,000 (a rise of over 9,000%) despite the fact that – as everyone agrees – the cost of probate is much the same regardless of the size of the estate.

The fees will – just like inheritance tax – be payable before the estate is distributed to heirs (so some people will need to borrow to pay). This isn’t a good tax – much better would have been just to cut the inheritance-tax threshold or raise the rates (or do nothing).

But as most estates worth over £2m will be worth over £2m because they have houses in them, it does at least do something of what the government has long wanted to do: take a slice of the mostly unearned capital gains on UK residential property.