In MoneyWeek magazine this week: four bargain retail stocks to buy now; why you must be invested in Europe; and how better investing can solve inequality

Plus, how to tidy up your credit report; some of the best ways to give to charity; and can you have faith in your pension trustees? All that, plus our usual news, views, share tips and more. Why not sign up now?

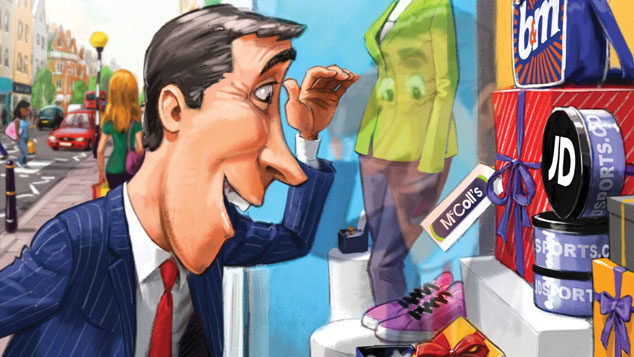

The retailers to buy now

There’s a sense of doom hanging over the retail sector. The high street is in decline, with traditional “bricks and mortar” retailers just waiting for the likes of Amazon and a host of other online upstarts to wipe them out completely.

But it’s not all bad, says Phil Oakley. Sure, the new crop of dotcom stores have seen profits and share prices soar, but many traditional retailers are doing very nicely thank you. Retailing is just like any other sector. There may be threats, but there are also some big opportunities. For investors, “it’s all about finding the right stocks at the right price.. there are still potential pots of gold out there for long-term buyers.”.

Phil has a pretty good record when it comes to picking stocks – indeed, he’s written a book on this very subject. So If he thinks something’s worth buying, it’s always a good idea to take notice. This week, he picks four stocks that he thinks will continue to prosper. Why not sign up now?

Europe is bouncing back

After the financial crisis of 2008, Europe’s economy struggled. And , to be fair, it’s still not what you’d call in rude health. But, says Max King, “whatever the outlook for the broader economy, the financial system and the euro, Europe remains home to a significant number of successful, world-leading companies”. And that makes it difficult for investors to ignore. The MSCI European index (excluding the UK) returned more than 25% in euro terms in the last 12 months. So how should investors approach it? Max picks four of the best performing funds to buy now,Why not sign up now?

How better investing can help reduce inequality

According to a research paper published by the Stockholm School of Economics recently, the rich keep getting richer because they are better investors. That may not come as much of a surprise, says Matthew Lynn in his city View column this week – the rich have more money because they’re better with money. But it’s not so much that they’re better at picking stocks – they aren’t. It’s that they have a different attitude to investing – and to risk in particular – than people with less money. Matthew’s theory is that if we want to reduce inequality, the best way to do it could be the persuade the middle class to take on more risk, giving them “a chance to catch up on the wealth being accumulated by the very richest.” It’s a bold theory. So, how should we go about that? Why not sign up now?

Tidying up your credit report; giving to charity; and can you trust your trustees?

You may think you’re a pretty good credit risk, but even so, “it is a good idea to check that the information on you held by credit-rating agencies is correct”, says Sarah Moore. “The smallest of discrepancies on your record could have major ramifications when you come to apply for credit.” It wouldn’t do to be turned down for a mortgage because of a dormant account somewhere that you’d forgotten about throwing a spanner in the works. Sarah explains what to look out for, and how to make things right if you spot any errors.

I’m sure many of you give handsomely to charitable causes. Perhaps you donate things to charity shops, or have a string of direct debits going out. But with a little bit of effort you can make your gift go a long way further. Marc Shoffman looks at how the best ways to do that – whether you give from your income or your assets, and how best to support charities through your investments.

Trustees, says David Prosser, “are the front line of defence for defined-benefit pensions-scheme beneficiaries in the UK”. They protect scheme members’ interest from “the often-conflicting demands of employers and individual savers.” But they’re not always up to the job. Indeed, says David, many “aren’t even getting the basics right”. Find out why – Why not sign up now?.

There’s more, of course. David C Stevenson looks at a novel development in the peer-to-peer (P2P) lending sector – a big chunk of P2P buy-to-let loans has been included in a large securitisation of loans with an AAA rating. It’s a big deal, says David, but is it something you should put your money into? Emma Lunn gives some practical advice to landlords, and runs through the extremely long and fiddly list of things they must do to comply with the law. And Simon Wilson explains how, in the US, state and city governments are taking power into their own hands and acting unilaterally in areas they think the federal government just isn’t doing the right thing.

That plus, our big roundup of the UK press’s share tips of the week, news from the markets, politics and economics, and in the back, we look at the Tesla Model 3, dubbed “the iPhone of the car market”, some impressive sporting estates for sale, and three of the best “glamping” trips. Why not sign up now?