The crisis in the periphery of the eurozone is far from over. But unlike the Mediterranean countries, Ireland has recovered so strongly – it grew by 5.2% last year – that investors are now treating it as a core state, notes Kate Allen in the Financial Times.

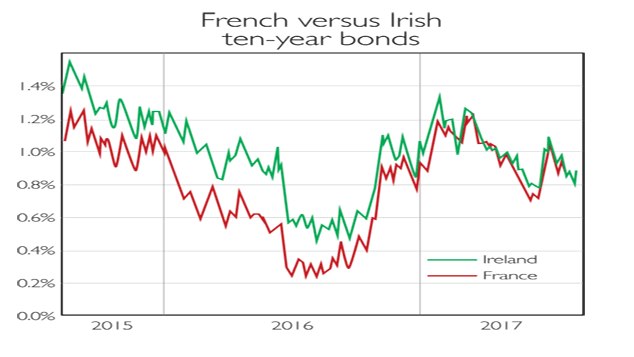

The gap between the German ten-year bond yield and its Irish counterpart has fallen to decade lows. The difference with French yields has narrowed of late too. Indeed the Irish yield has edged below the French one at times, implying Irish paper trading at a higher price – despite France traditionally being deemed the better credit risk.

Viewpoint

“[Many UK manufacturers] would very happily trade a stronger pound for continued membership of the single market… We should… get away from the idea that you can devalue your way to export success. In the mid-1970s the exchange rate of the Deutsche mark to sterling was just under six. Now, based on the current euro-sterling rate, the rate would be around DM2.1. Sterling has suffered a 63% devaluation in relation to the German currency… Yet there is no doubt which country is the more successful exporter. If devaluation was the key to export success, Britain would be a world champion. The reasons for such success go much deeper.”

David Smith, The Times