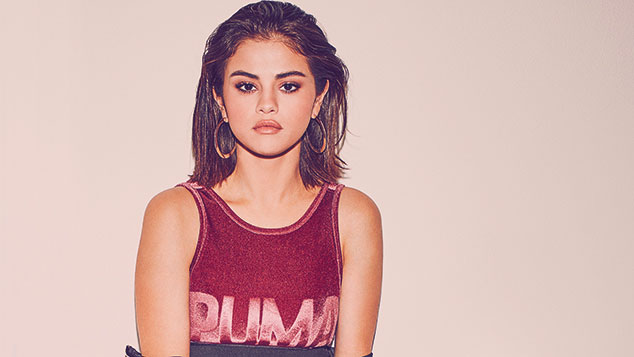

Eleven years after the €52bn Gucci owner bought Puma, it is letting go of the brand to focus on luxury goods. Alice Gråhns reports.

“Gucci-owner Kering has chosen an opportune moment to let go of its $4.9bn stake in Puma,” says Stephen Wilmot in The Wall Street Journal. Sprinter Usain Bolt raised the visibility of the German trainers brand, but problems at rival firm Nike have also helped Kering “race out of its less than record-setting investment”.

Under chairman and controlling shareholder François-Henri Pinault, Paris-listed Kering has spent the past decade transforming itself from a retail conglomerate into a luxury group. Thus, “disposing of its long-suffering 86% stake in independently listed Puma – most of which was bought for €330 a share in 2007 – is the final step”.

Yet “investors are taking it like a fashion faux-pas”, says Andrea Felsted in Bloomberg Gadfly. Rather than find a buyer willing to pay a premium for its stake, Kering plans to distribute 70% of its holding in Puma to its own shareholders. The news sent Puma’s stock down 16% last week, its biggest fall in almost 17 years. Kering’s own shares slipped 2.4%.

A good time to sell

But “investors should get over their disappointment”, continues Felsted. The sale is “a well-timed move”. It should help Kering attract a premium valuation as a pure luxury brand, and also provide some defence for when Gucci’s “phenomenal growth” begins to slow. Puma’s performance has also improved, with the stock up 45% in the past year, partially thanks to increasing demand for “athleisure” products.

Kering will keep 16% of the company. The Pinault family’s investment arm, Artemis, will also hold on to the 29% stake in Puma it will get from its 41% ownership of Kering. The proportion of Puma’s shares that are freely tradable will increase to around 55%, notes Reuters.

Puma’s shares are still trading at around the price originally Kering bought. “That’s hardly stellar”, says Carol Ryan on Breakingviews. Kering might have preferred to sell at a higher price. “Nonetheless the valuation has been nursed back to relative health following a spell of underperformance several years ago.”

Kering, on the other hand, has traded at a lower price/earnings ratio than its larger French luxury rival LVMH for most of the past decade. This week, however, it edged ahead to trade at around 23 times estimated forward earnings. Indeed, by getting rid of the last of Kering’s less exclusive brands as well as a lower-margin business, Kering should be able to lift its own profitability. Group operating margin was 16.9% in the first half of 2017, compared with the luxury division’s 24.9%. Essentially, by focusing on pure luxury, “it is gaining race-fitness”.

Carillion’s messy collapse will hurt others

“Government contractor Carillion’s collapse into liquidation is an embarrassment for all concerned,” says Lionel Laurent in Bloomberg Gadfly. Its demise may have been triggered “by a perfect storm of several projects going wrong at the same time, but the long-term causes lie in its racy expansion and over-reliance on debt”. Between 2012 and 2016, net debt to equity doubled from 15% to 30%. The company responsible for delivering large-scale projects such as the HS2 high-speed rail link (see page 13) tried to sober up, but too late. “The hard work of cutting debt and dividends only began in 2017.”

Carillion’s creditors including HSBC, Santander and Barclays, now face a fight with Britain’s pensions regulator over the proceeds from the sale of potentially valuable contracts and £144m in physical assets, says Aimee Donnellan on Breakingviews. Meanwhile, “the rapid collapse could also knock confidence in other providers of outsourced construction and maintenance contracts.”

UK builders Balfour Beatty and Galliford Try face a shortfall of up to £80m on a £550m joint venture with Carillion to build a motorway bypass outside Aberdeen. Shares in both firms declined, as did those of industrial equipment rental company Speedy Hire, for whom Carillion was a large client. But construction firm Kier and other outsourcers such as Serco rallied “as investors bet there would be more contracts for others following the company’s demise”, notes Reuters.

City talk

• It’s hard to avoid a grudging respect for Jeff Fairburn, the CEO of housebuilder Persimmon, says Neil Collins in the FT. He came out fighting to defend his £100m bonus payment, saying he had worked jolly hard for it. But Persimmon has “made profits beyond the dreams of avarice” as a result of the “economically illiterate ‘help to buy’ policy”. This has in effect turned into a subsidy for housebuilders and a “‘help to buy yachts’ policy for housebuilding execs.

Perhaps executives at the leading Persimmon shareholding institutions were too busy to read through the details to object when they voted the bonus package through. Alternatively, they feared to do anything that might put their own rewards package in the spotlight. After all, they want their yachts too.

• Nobody expects miracles from Marks & Spencer, but surely the online operation would turn in some juicy figures? Seems not, says Nils Pratley in The Guardian. M&S went through agonies to build its expensive distribution centre at Castle Donington, yet sales growth at M&S.com was a “miserable 3%”. CEO Steve Rowe blamed “restrictions on our ability” at Donington; he meant M&S often missed its delivery targets. Without reliable distribution, he’s “fighting with one arm behind [his] back”.

• Barely was the news out about Melrose’s £7bn tilt at GKN, the car component and aerospace outfit, than up popped ex-business secretary Vince Cable with “some prize populist nonsense”, says Alistair Osborne in The Times. He demanded the government prevent “this damaging takeover”. However, GKN has been limping along for ages – as November’s profits warning makes clear. Meanwhile, Melrose’s “buy, improve, sell” model has delivered billions of pounds of value over 15 years. “If Melrose bumps the price, GKN will need a lot more than Sir Vince to win this fight.”