If only…

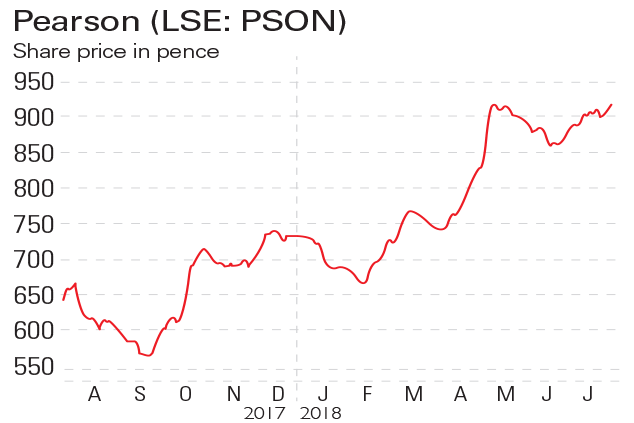

Pearson (LSE: PSON) is a global publisher of teaching resources. After a series of profit warnings and losses in recent years, things are starting to look up. The shares rose in October as the firm said it expected full-year operating profits to be in the upper half of its forecast range of £546m to £606m, helped by strong trading in its core US textbook division. The shares rose again in May as Pearson reported a 1% rise in revenues in the three months to March. CEO John Fallon is trying to revive the business by ditching non-core assets and cutting the debt pile.

Be glad you didn’t…

Xaar (LSE: XAR) develops ink-jet printing technology. Its shares fell by roughly 20% in November as the firm issued a profit warning due to tepid sales. Xaar also said that it was reducing its reliance on its ceramics-printing division. In June, its share price plunged again as Xaar said the performance of the ceramics business had been below expectations in the first five months of the financial year. As a result, Xaar announced that it would make cost reductions, including staff redundancies, to achieve full-year profits in line with expectations.