We have a new podcast for you this week, in which Merryn and I pretend that we aren’t going to talk about Brexit and yet we still do. But you’ll probably be far more interested in the prospect of a market melt-up – a surge in the stockmarket, for those who aren’t familiar with the term – yet we still do

Also – don’t miss Merryn’s latest piece on Brexit and UK stocks – this column will enrage or enrapture depending on your point of view (I think Merryn’s right for what it’s worth).

And for more on Brexit, melt-ups, and other investable topics, please do come to our event on the evening of 12 February. I’ll be talking to MoneyWeek regular Tim Price and Netwealth’s Iain Barnes about the latest goings on in the market. Get your ticket here if you haven’t already.

If you missed any of this week’s Money Mornings, here are the links you need.

Monday: China’s biggest problem is not Donald Trump – it’s a lot worse than that

Tuesday: Index investing is revealing the flaws in our model of shareholder capitalism

Wednesday: The conditions are ripe for a spike in the price of this metal – here’s how to invest

Thursday: Markets are starting to think that “no deal” Brexit is off the table – are they right?

Friday: Why investors could get a pleasant surprise this year

Oh and do subscribe to MoneyWeek if you haven’t already. If you like Money Morning, you’ll love the magazine. I’m hoping that’s a sufficient sale pitch, but in case it’s not, you also get a whole lot of share tips thatdo subscribe to MoneyWeek if

And now, over to the charts.

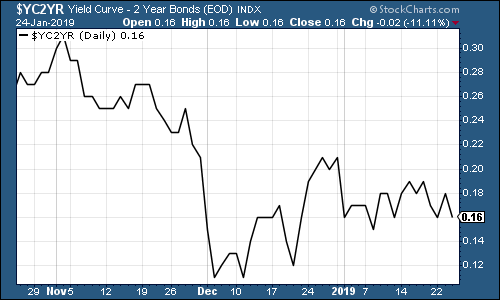

The yield curve (here’s a reminder of what it is) isn’t making anyone feel any better about the world right now. It’s stubbornly refusing to move away from “dancing on the edge of a recession” territory, although we’re not there yet.

The chart below shows the difference (the “spread”) between what it costs the US government to borrow money over ten years rather than two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year: going back three months)

Gold (measured in dollar terms) has however, been more subdued this week as the markets remain caught between “risk-on” and “risk-off” mode. MoneyWeek regular Charlie Morris gave us his view on gold last week – if you missed it, I recommend you read his piece.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – continued to rally this week, although that was largely due to the European Central Bank helping to weaken the euro at its meeting this week, where it reduced its Why investors could get a pleasant surprise this year.

(DXY: three months)

The ten-year US Treasury bond yield was again little changed this week, as were other developed world government bonds – the Japanese government bond (JGB) yield is still flatlining, while the ten-year German bund yields (the borrowing cost of Germany’s government, Europe’s “risk-free” rate) fell sharply as it becomes ever clearer that Europe is enduring a serious slowdown.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

Copper rallied then stalled this week. There are hopes that China will stimulate its economy – but fears that it won’t be enough. And on top of that, there’s the constant “will they, won’t they” on the trade deal side.

(Copper: three months)

The Aussie dollar – our favourite indicator of the state of the Chinese economy – rallied then fell, and thus continued to amble around the $0.71 mark. Markets are starting to realise that any trade deal between China and the US may take some time – but they remain hopeful of a stream of decent news to keep them running on optimism for the time being.

(Aussie dollar vs US dollar exchange rate: three months)

Unusually, cryptocurrency bitcoin did pretty much the same as everything else this week – hung around in a tight range, not sure of what to do with itself.

(Bitcoin: ten days)

One indicator that is still moving in the right direction is the four-week moving average of weekly US jobless claims. It dropped this week to 215,000, as weekly claims came in at a much lower-than-expected 199,000, which is the lowest level in nearly 50 years. Now we have to take this data with a pinch of salt because claims for various states were estimated (not because of the government shutdown but because of the Martin Luther King holiday). But it’s still impressively low, regardless.

Gluskin Sheff’s David Rosenberg has noted in the past that US stocks typically don’t peak until after the moving average of jobless claims has hit a low for the cycle. On average, the stockmarket peak follows about 14 weeks from the trough, with a recession following about a year later. (Of course, this is taken from a small sample size with a lot of variation, so you can’t even think about setting your clock by these figures.)

The most recent trough came on 15 September, at 206,000. If that’s the bottom, it would imply that the stockmarket has already peaked, and that a recession may follow this year or in 2020. That’s certainly a believable outcome.

And yet at this rate, we could also easily see another trough. If that’s the case, you might also see another high in the stockmarket (which resonates with the “melt-up” scenarios yet we still do

In short, I think there’s still everything to play for right now. But employment is certainly worth watching, because it’s also the key driver of wage inflation and therefore wider inflation in the economy.

(US jobless claims, four-week moving average: since January 2016)

Like every other risk asset this week, the oil price (as measured by Brent crude, the international/European benchmark) didn’t do much. It managed to hold above $60 a barrel by the end of the week, but it’s unlikely to make much progress until wider markets decide what they want to do, and until there’s evidence of an improving growth outlook.

(Brent crude oil: three months)

Internet giant Amazon still isn’t back in a clear uptrend. In fact, this week it stalled as it was close to getting back above its last rally attempt. Until it breaks that, I wouldn’t want to say for sure that we’re back in “buy the dips” mode.

(Amazon: three months)

Electric car group Tesla took a big hit this week after Friday’s profit warning, where it said it would struggle to make any money this quarter, and that it was cutting 3,400 jobs. Wall Street has a reputation for liking job cuts, but not in a company that’s largely sold on the basis of being a fantastic growth play – slashing back when you’re meant to be an ever-expanding future behemoth does not make your investors cheer.

(Tesla: three months)

Have a great weekend. Don’t forget to get your ticket for our event on February 12th – given the state of our politics and our markets right now, it’s one Get your ticket here if you haven’t already..