The British gambling sector has been hit by taxes and tighter regulation. But the depressed share prices have yet to factor in the compelling long-term growth outlook, says Stephen Connolly.

Britain’s £14.5bn gambling industry was dealt a double whammy last year. First, the government slashed the maximum stake on highly profitable fixed-odds betting terminals (FOBTs), electronic slot machines containing a range of games, from £100 to £2. Second, to make up for the lost tax revenue, it hiked duties on online and mobile casino-style games from 15% to 21%. On balance, this is likely to be neutral or maybe slightly positive for the public finances, but it certainly tears a hole in the industry’s profits; many highstreet betting shops will disappear.

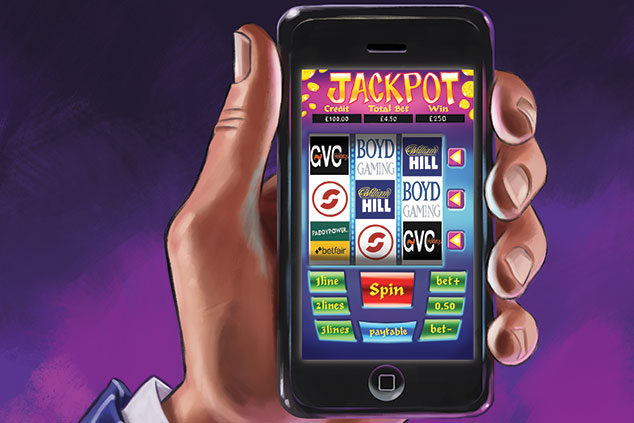

Nevertheless, despite the gloomy backdrop and sinking share prices, the sector is hardly a write-off. It is in a state of flux, gradually adapting to the tough conditions and eyeing up future growth in online and mobile gambling. It is also investing in sustainable growth overseas, especially in the US where stringent gambling regulations are being relaxed.

What’s more, low stock valuations now reflect the British regulatory shock and subsequent downgrading of profit expectations. What they don’t reflect, however, is the scope for future growth. This could therefore be an opportunity to place your bets on the gambling sector on the cheap.

Looking beyond Britain

Profitability is set to trough in the next year owing to the combination of lost UK profits and investment in US expansion. After that, however, the industry could be generating robust earnings growth. Of course, the UK high-street betting shop business – which houses the FOBTs – needs attention, with some companies having to do more than others.

For William Hill and GVC (which owns Ladbrokes Coral) in particular, as operators of the bulk of the UK’s 8,400 high-street betting shops, a top priority will be adapting their retail operations to fit a markedly less profitable market after the stake cut takes effect in April.

According to the Gambling Commission, people betting in shops, or physical betting, currently adds up to £3.2bn. That represents 22.5% of the UK’s total gross gambling yield (GGY), a standard measure of all the money wagered by punters minus the winnings paid out. But this includes 33,000 FOBTs which brought in £1.7bn last year, more than half the total. It’s impossible to gauge exactly how customers will adapt to the £2 stake, but the initial hit could be mitigated slightly by upgrading products and overhauling shops to maintain and attract customers. More significantly for the bottom line, leasing arrangements will be optimised and shops shut.

“Brazil, India and Russia are all developing online gambling regulation”

The sector itself is upbeat beyond UK regulatory difficulties. William Hill, for instance, still has ambitious profit targets over the next four to five years despite heavy reliance on FOBTs. The general optimism is based on two imperatives. First, the industry knows that more and more people will bet remotely, whether on the internet or their mobile phones, and there are betting markets around the world where remote gambling has barely penetrated. Second, to avoid significant regulatory obstacles, it must re-balance business by diversifying geographically. These overlapping strategies offer considerable scope for tapping new revenues.