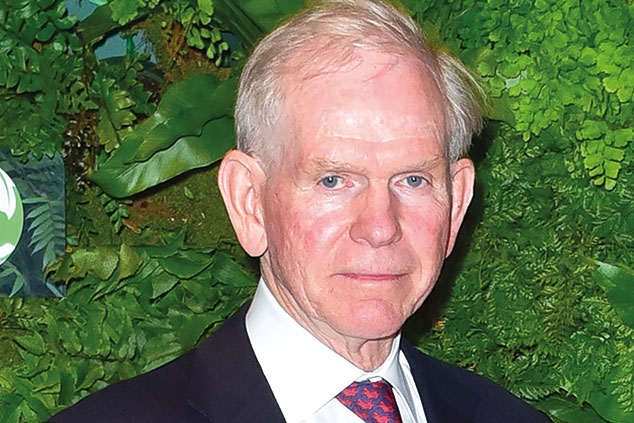

Grantham, who founded contrarian asset manager GMO, is much keener on emerging markets, where he reckons that over the same timescale “you can do maybe 7% or 8% if you tilt towards value”.

China is “massively outproducing the US in the number of engineers and scientists”, which makes “it difficult for them not to take the lead in science” and to surpass the US economy in size within a few years. Meanwhile, India is growing at 6% a year. But more importantly, says Grantham, emerging markets are “much cheaper than normal” right now. He cites The Economist’s Big Mac Index, which compares what a hamburger costs in different countries. “It’s always been 25% cheaper to buy a Big Mac in an emerging country, but now it’s half price. So they’re unusually cheap.”

Grantham – who is a climate activist – drives a Tesla, but as a value investor, it’s “not his kind of stock”. However, he does see huge opportunities for entrepreneurs in tackling environmental charges – but only if the US government changes its approach to taxation. “Once you tax carbon… the ingenuity that will spring out of the venture capital (VC) industry will be fabulous… there is a lot of hope if you can release the entrepreneurial and inventive spirit, and a carbon tax would do that.”