Welcome back. The first stage of the Brexit denouement is (hopefully) drawing ever closer. So book your ticket for the MoneyWeek Wealth Summit where we’ll be discussing what might happen next with a panel that includes Steve Baker MP and MacroStrategy Partnership’s James Ferguson.

That’s just the start of the day. We’ll be looking at how to avoid a future Neil Woodford with our panel of investment trust experts. We’ll be talking to British investor and entrepreneur Jim Mellon about the hottest future trends in investing right now.

And we’ll have a host of other panels covering everything from how to plan for retirement, to how to find a good wealth manager, to avoiding the most common tax-planning errors.

Oh yes, and Merryn will be on stage interviewing James Anderson, one of the most successful active investors in the UK.

It’ll be the most profitable day out you’ll have this year. Don’t miss out – book your ticket now.

Podcasts, Money Morning and Currency Corner

On the podcast front, we’ve got another new one for you this week – a fourth recording from Merryn’s Edinburgh Fringe festival show (I made a mistake when I said last week’s was the final one…!). Merryn sits in Adam Smith’s front room and talks about economics and sustainable capitalism with fund manager Tim Price, academic Robert Macintosh, and one of our favourite big picture analysts, Russell Napier (Russell is at the Wealth Summit too by the way). Listen here.

Oh, and if you fancy a highly relevant blast from the recent past, here’s me and Merryn talking about Neil Woodford back in June, just after his Equity Income fund was first closed to withdrawals. I think most of what we said here has stood up pretty well.

If you missed any of this week’s Money Mornings, here are the links you need:

Monday: Trade wars and Brexit: are we really any closer to deals?

Tuesday: The fall of the house of Woodford – and what it means for your money

Wednesday: How tax has shaped the course of human history

Thursday: Beyond the Brexit talk, the British economy isn’t doing too badly

Friday: We have a Brexit deal – but can it get past Parliament?

Currency Corner: what does Boris Johnson’s Brexit deal mean for the pound?

Subscribe: Get your first 12 issues of MoneyWeek for £12

Deal: get 25% off a copy of my book, The Sceptical Investor

And for all the latest on Woodford, keep an eye on our dedicated Neil Woodford page.

The charts that matter

Two big things happened this week to boost investors’ mood. China and the US did a half-hearted trade deal, but at least they’re no longer outright hostile to each other. And Brexit came close to being solved – although we’ll see how close we really are by the time this weekend is over.

Anyway, the gentle pick up in sentiment can be seen in our “charts that matter”.

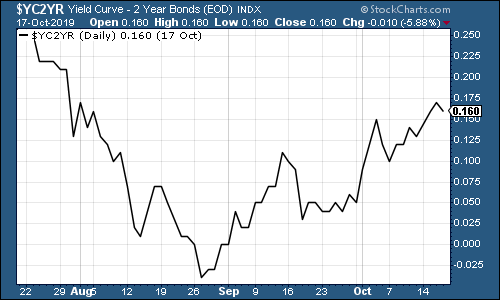

The yield curve inverted at the tail-end of the summer, which is an indicator that recession will likely arrive in 18 to 24 months. While it’s back in positive territory now (in other words, the yield on the ten-year US government bond is higher than the yield on the two-year, which is how things should be), that’s not really relevant. Once the inversion has happened, it’s happened, and the reversal doesn’t really matter.

So why keep watching it? Because I’d like to see if it works out this time as well, just for future reference.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) drifted sideways. Investors aren’t as terrified as they were a few months ago, and it could also do with a bit of time to settle after its rampant run earlier this year.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – has again drifted lower alongside gold this week as demand for “safe havens” eased up.

(DXY: three months)

The number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) also continued to fall back, another sign that investors feel more optimistic.

(Chinese yuan to the US dollar: three months)

And yields on ten-year yields on major developed-market bonds, have risen across the board, again showing that investors are less concerned about piling into “safe” investments than they were just a few short weeks ago. Below you can see the US…

(Ten-year US Treasury yield: three months)

And Japan…

(Ten-year Japanese government bond yield: three months)

And Germany, which would be a big beneficiary of a smooth-ish Brexit.

(Ten-year Bund yield: three months)

However, the price of copper had a tougher week as the mellowing of trade talks was offset by very gloomy Chinese economic data.

(Copper: three months)

The Aussie dollar on the other hand, made solid gains again the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin slipped a little further this week.

(Bitcoin: ten days)

US weekly jobless claims rose this week to 214,000, in line with expectations, up from 210,000 last week. The four-week moving average rose a little to 214,750. So again, we still aren’t seeing the sustained uptrend that would indicate that a recession is close – although that is starting to look like an upward curve at the end of the chart…

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark), was little changed. Concerns over turmoil in the Middle East and the long-term viability of shale were matched on the downside by concerns over China’s weak data.

(Brent crude oil: three months)

The share price of the great disruptor Amazon moved a bit higher this week.

(Amazon: three months)

Meanwhile shares in electric car group Tesla continued to rise.

(Tesla: three months)

Have a great weekend. And do make sure to Don’t miss out – book your ticket now.!