Hurry! Time is running out to book your seat at the MoneyWeek Wealth Summit! There’s less than a fortnight to go!

Join us in London on Friday 22 November for a full-day investment and economics extravaganza.

To kick off the day (well, after chatting over breakfast), we’re pleased to announce that we’ve just secured the presence of Daniel Hannan, MEP, who’ll be discussing political risk and opportunity with James Ferguson of MacroStrategy Partnership and the fantastic Gillian Tett of the FT.

Financial historian and analyst Russell Napier will then give us his always-fascinating and always-contrarian views on the economic outlook.

After a quick break for coffee, my colleague Merryn will be talking to some of the finest minds in the investment trust sector – Dan Whitestone of the BlackRock Throgmorton, Sebastian Lyon of Personal Assets Trust, Miton’s Nick Greenwood, and SImon Elliott of Winterflood.

British investor and entrepreneur Jim Mellon will then take to the stage to share the most exciting opportunities in the most exciting investment sector – longevity – with us.

And that’s all before lunch! Just wait until you see what we’ve got lined up for the afternoon!

You can’t afford to miss it. Check out the full agenda and book your ticket here. Hope to see you there!

Podcasts, Money Morning, Currency Corner and Merryn’s blog

A new podcast for you! Merryn and I discuss the election (briefly); consider cheap Japanese stocks and ponder the sheer awe-inspiring scale of the Japanese bubble of the 1980s; talk about money printing and inflation; and whether it’s time to buy Patient Capital Trust yet…

If you missed any of this week’s Money Mornings, here are the links you need:

Monday: The Saudi Aramco IPO could mark the bottom for oil

Tuesday: If you don’t know what’s in your ethical fund, are you really an ethical investor?

Wednesday: No one cares about the oil market – that’s why it’s a good time to invest

Thursday: MMT is coming, the US dollar is here to stay, and “value” investing is dead: an interview with Dylan Grice

Friday: Governments have got the message – right or left, a spending binge is coming your way

Currency Corner: It might be time to back the euro against the yen

Subscribe: Get your first 12 issues of MoneyWeek for £12

And do check out Merryn’s latest FT article, in which she relates how a quest to find the perfect pony ended up with her pondering the value of breakdown insurance and the degradation of Britain’s biggest motoring names by private equity.

Oh and if you haven’t read my book, The Sceptical Investor, then why not pick up a copy now? It’ll make a great early Christmas present… for yourself.

The charts that matter

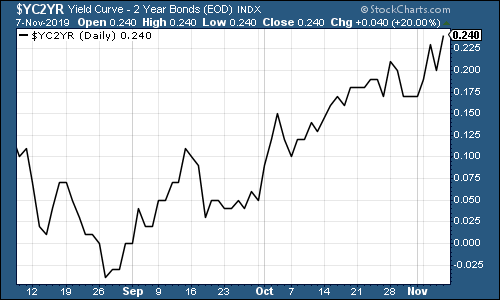

The yield curve

became steeper this week. The yield on the ten-year US government bond is higher than the yield on the two-year, which is the way it should be, and it’s getting higher. This is mainly down to the “risk-on” mood gripping markets.

Thing is, the curve inverted towards the end of August (in other words, the yield on the two was higher than the ten), which usually indicates that a recession is on the way within 18-24 months. As ever, analysts are falling over themselves to argue that it’s different this time and maybe it is – it was a very short inversion indeed – but the odds are not in favour of that being the case.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) fell pretty hard this week, because when other assets are doing well (when the market is pursuing “risk-on” assets), gold falls out of favour. That’s why you own it. It’s called “diversification”. When everyone starts worrying about inflation again it will probably perk right back up.

(Gold: three months)

Meanwhile, the US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – bounced from the 97 level. If we want to see a sustainable “risk-on” mood you have to expect the dollar to weaken. If it doesn’t, that could definitely take the shine off things.

(DXY: three months)

A more encouraging indicator on the currency front is that the number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) also fell. When the yuan first weakened to the point where you could get seven to the dollar, everyone got worried. That was viewed as a “line in the sand” for the Chinese government.

The fact that the yuan breached it, suggested that China might be preparing to devalue its currency hard, which would have sent a deflationary wave around the world.

But the yuan has now strengthened again to the point where it’s back below the magic seven mark. That’s got to have helped to improve the market mood this week.

(Chinese yuan to the US dollar: since 25 Jun 2019)

Ten-year yields on major developed-market bonds moved significantly higher this week. The Fed is printing, governments around the world are promising to join in the party – what could go wrong?

The yield on the US ten-year was sharply higher by the week’s end. I’ve updated these charts to the six-month view this week because we’re now at fresh highs on the three-month view.

(Ten-year US Treasury yield: six months)

The Japanese ten-year is now close to offering a positive yield (in nominal terms) for the first time in a long time.

(Ten-year Japanese government bond yield: six months)

And Germany has rebounded hard too, helped by improved economic data.

(Ten-year Bund yield: six months)

What with copper being a “risk-on” metal, it enjoyed a solid bounce this week, helped by signs that China and the US might be starting to get on a bit better.

(Copper: six months)

The Aussie dollar had a relatively quiet week against the dollar. But over the slightly longer run, it looks as though it is starting to claw back ground lost in the summer.

(Aussie dollar vs US dollar exchange rate: six months)

Cryptocurrency bitcoin spent most of the week just pootling around in the $9,000-$9,500 range.

(Bitcoin: ten days)

US weekly jobless claims fell to a one-month low of 211,000 this week, a better result than expected, from 214,000 (revised up from 213,000) last week. The four-week moving average came in at 215,250. So, in short, no signs of an uptrend yet, which suggests that all the fears about a pending recession still look overdone.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) climbed somewhat this week. It looks to me as though oil is a bit of a ‘forgotten asset’ at the moment, which is one reason No one cares about the oil market – that’s why it’s a good time to invest

(Brent crude oil: three months)

Internet giant Amazon was little moved this week despite the broader market making new highs. It does look as though the “leadership” might be moving away from the big tech stocks, and the less widely-loved sectors might be ready for their time in the limelight. Maybe it’s time for “value” to make a comeback?

(Amazon: three months)

Shares in electric car group Tesla continued higher this week. Elon Musk got back on Twitter this week to talk up the group’s future launch of a “cybertruck” (that’s an electric truck to me or you).

(Tesla: three months)

Have a great weekend. And remember, it’s less than two weeks to 22 November!