The price of gold has slid to around $1,050 an ounce, its lowest level since February 2010. Gold pays no interest, and so tends to fall if interest rates on other assets are expected to rise.

The US Federal Reserve could start raising US rates as early as next month, making US securities more appealing. Gold is also priced in US dollars, and so struggles when the dollar is strong; the prospect of higher rates is also fuelling the dollar bull market.

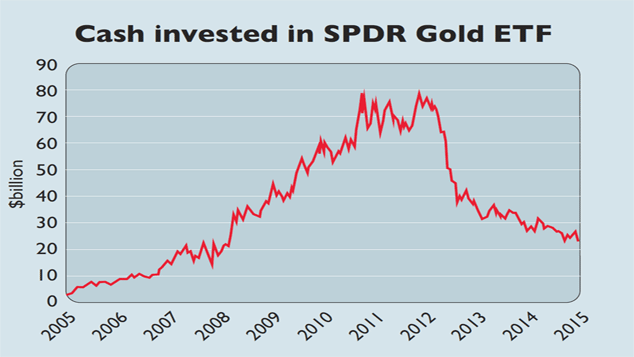

The slide in the amount of cash invested in America’s biggest gold-backed exchange-traded find (ETF), SPDR Gold ETF, is a stark illustration of investors’ growing disenchantment with gold. On the other hand, with gold this out of favour, there should be scope for a decent bounce if sentiment changes and people rush back in.

In light of ongoing concerns about financial markets, we’d still suggest owning some gold as portfolio insurance.