The grocer is struggling, but the shares are a cheap source of income, says Phil Oakley.

Can things get any worse for the big supermarket chains? Their share prices have been hammered as they face up to what seems like a perfect storm.

Tesco has slashed its dividend and it’s very likely Morrisons will too as both companies’ profits tank. The stock market seems to think that Sainsbury’s future is almost as bleak.

If you have a look at the supermarket sector as a whole, it’s easy to see why investors are so downbeat.

According to the retail experts, discount supermarkets Aldi and Lidl are the new powerhouses of the sector who will kill the big chains with their low prices. I’m not so sure about this, but lots of people believe the theory.

Then there’s the fact that more people are buying food and household goods online. This makes it harder for the chains with large stores to cover their costs and make a decent profit.

There’s also the latest figures from the Office for National Statistics, which showed that the volume of food sold in the UK has fallen for the first time since records began in 1989.

And for some, the most worrying development of all is the recent departure of Sainsbury’s chief executive, Justin King. Has he followed the example of Tesco’s Terry Leahy in 2011, and got out just before things turned sour?

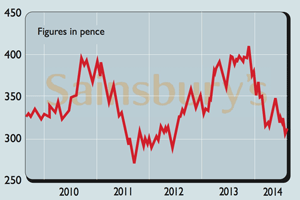

All this doom and gloom has left Sainsbury’s shares hovering just above their 52-week low and looking quite cheap on many valuation measures.

So, is Sainsbury’s dividend doomed and its shares a value trap? Or have the current woes created a buying opportunity for contrarian investors?

The outlook

As far as many professional investors are concerned, the outlook for Sainsbury’s is bleak. Quite a few of them have shorted its shares. In other words, they have borrowed shares and then sold them in anticipation of buying them back later at a cheaper price.

No doubt many investors are worried about the Aldi/Lidl issue, but Tesco is also a concern. Tesco’s new CEO will start work soon, and many fear that he will cut prices and force Sainsbury’s to follow suit. That could inflict serious damage on Sainsbury’s profits and make its dividend unaffordable.

This is a simple and very powerful argument and one that could conceivably come true. However, it is heavily dependent on the view that all Tesco’s problems are down to the prices in its shops. I don’t think that’s the case.

There are other issues, such as food quality, the presentation of its stores, the large number of out-of-town hypermarkets and struggling businesses in eastern Europe and parts of Asia.

What’s more, despite all the doom-mongering, Sainsbury’s has actually coped with the rise of the discount supermarkets very well. Instead, Tesco and Morrisons have been the big losers.

Despite the threat of Aldi and Lidl, Sainsbury’s has been increasing its share of the grocery market over the last few years and has been able to hang on to most of those gains recently.

In many ways, Sainsbury’s has created a decent niche for itself – a halfway house between the cheap end of the market and the perceived quality products on offer from Marks & Spencer and Waitrose. Sainsbury’s has done well with sales of its own-brand food and non-food items, such as clothing and cookware.

As well as keeping its prices competitive, Sainsbury’s has been in tune with changes in the way that people shop. It has made itself more competitive by building up a very successful online retail business and has invested heavily in convenience stores rather than big out-of-town supermarkets. This has put Sainsbury’s in a good position to keep its head above water in the years ahead.

Sainsbury’s finances are also in good shape. Its stores seem well looked after and it hasn’t got too much debt. It’s also encouraging that the chain plans to spend less money on adding new retail selling space.

Capital expenditure could come down by around £100m a year, which will give the company’s cash flow a nice boost and make it easier to keep paying a decent dividend.

That said, the key reason to buy Sainsbury’s shares is not because it’s a great business. It isn’t. Its return on capital employed (ROCE) is a very modest 11% – hardly a hallmark of a great company.

No, the attraction is that the shares are being bombarded by so much negative sentiment. Even the company’s own stockbroker turned more downbeat recently. Yet times of pessimism can be just the right time to buy the shares of a company. All you have to be is patient enough to wait for things to get better.

I’m not under any illusions that Sainsbury’s is going to be a great growth company, nor that trading will be easy. The thing is, though, that Sainsbury’s doesn’t have to grow for shareholders to make money.

The share price is telling us that the chain probably won’t grow its profits again, and that means you can snap up the shares now for less than their net asset value and get a dividend yield of over 5%.

If Sainsbury’s manages to keep on defying the naysayers, then all those short-sellers will have to buy back the shares they have sold. At that point, the shares could bounce sharply higher.

Verdict: a contrarian buy

Sainsbury’s (LSE: SBRY)

Share price: 306p

Market cap: £5.9bn

Net assets (March 2014): £6.0bn

Net debt (March 2014): £2.38bn

P/e (prospective): 10.3 times

Yield (prospective): 5.4%

Price to NAV: 0.98 times

Interest cover: 6.5 times

ROCE: 11.3%

Dividend cover: 1.8 times

What the analysts say

Buy: 9

Hold: 17

Sell: 8

Target price: 320p

Directors’ shareholdings

M Coupe (CEO): 960,487

J Rogers (CFO): 501,036

D Tyler (Chair): 50,000