The high demand for blue-chip dividend-paying stocks in recent years has made it very hard to find companies that can pay out high rates of income without taking on a lot more risk.

But if you are prepared to take a bit of a gamble, then some insurance companies are well worth a look. Speciality insurance companies such as this one can be quite difficult to understand and this can put people off investing in them.

They provide insurance against catastrophes such as hurricanes and floods. Working out how much to charge customers (the premium) and how much money to set aside to pay any claims is a skilled business. Getting these things right has a big bearing on the size of the dividends they can pay investors.

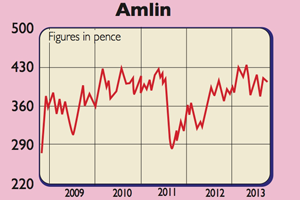

Amlin (LSE: AML)

Amlin has a good record of doing this. The company was able to increase its dividend throughout the financial crisis and has been able to withstand major disasters, such as Hurricane Sandy in 2012, and the low income returns on its investment portfolio.

While competition has increased in some of its insurance markets, it still sees itself as being able to make decent profits and keep on meeting its target return on shareholders’ equity of 15%.

Amlin shares are not particularly cheap, trading at 1.5 times book value, but the forecast dividend yield of 6% is attractive and it looks well placed to keep growing.

Amlin’s finances are in good shape too as it has £576m more capital than the regulator says it needs. This makes it a decent bet for income seekers.

Verdict: buy