Emerging markets are unpopular right now. China’s slowing appetite for commodities, unrest in Brazil, and the risk that the Federal Reserve may slow its quantitative easing programme, which has helped support emerging market stocks and bonds, have sent investors fleeing back to developed world economies.

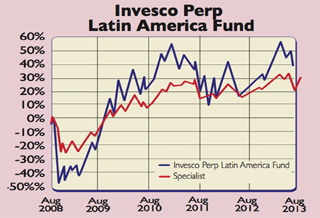

But Latin America – with its abundant resources – still holds promise for investors, says Andy Parsons of The Share Centre. And the Invesco Perpetual Latin America Fund, which has beaten its benchmark over one, three and five years, is “the ideal way” to play it.

Manager Dean Newman looks for stocks with “strong fundamentals, while also considering the broader economic environment”. The fund holds 50 to 60 stocks, with a bias towards companies that focus on domestic growth.

One of Newman’s biggest investments is in Panama-based airline Copa, which has long been a MoneyWeek favourite. A regional carrier, it benefits from growth across Latin America, making it a good way to play rising disposable income.

Other holdings that should benefit from rising consumer spending power are Brazilian telecoms firm Telefonica Brasil, and Ambev, a brewer that sells beer across the area.

Around 60% of the fund is in Brazil, 20% in Mexico and the rest is scattered around smaller economies, such as Chile and Peru.

With a total expense ratio of 1.75%, the fund is not cheap. But investors are buying into a specialist fund with a solid, long record –Newman has managed it since its launch in 1994. In that time he’s seen plenty of booms and busts, which should help him pick bargains in the current sell off.

Contact: 0800-028 2121

| Invesco Perpetual top ten holdings | |

|---|---|

| Name of Holding | % of assets |

| Itau Unibanco | 6.7% |

| Petroleo Brasileiro | 5.6% |

| Ambev | 5.3% |

| Vale SA | 4.1% |

| Copa | 3.6% |

| Arca Continental | 3.2% |

| Deutsche Bank Mexico | 3.0% |

| BM&F Bovespa | 2.8% |

| CIA Souza Cruz Ind E Com | 2.8% |

| Telefonica Brasil SA | 2.8% |