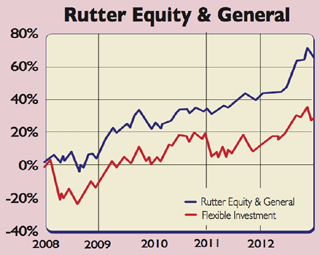

For most fund managers, the market’s recent tumbles won’t have been fun. Yet for Alex Grispos, manager of the Ruffer Equity & General Fund, they are ideal. Grispos is a “value investor, looking to buy out-of-favour stocks that he believes are undervalued”, says Joshua Ausden on FE Trustnet. That means that this year’s combination of a bull market interspersed with sharp sell-offs have been ideal. He’s taken advantage of rising markets to build up a cash reserve that can be used when the economic environment worsens.

At the end of May, Grispos had 31% in cash to fund a shopping spree when prices fell. This “ensures the portfolio is insulated from a steep market fall following a sustained upswing… and also gives the manager flexibility to cash in on cheap, quality stocks when the fall occurs”. The result is a fund that tends to beat its peers when markets fall, but does less well when they rally.

This year’s bull market provided Grispos with few opportunities. “Economic activity is improving, but the irony is that it is most difficult to find new ideas at current prices,” Grispos said in a recent note. “Few sectors in the market are undervalued and/or out of favour.” This is changing and there are bargains around, says Ausden, so “buying the fund now seems like a particularly good idea”.

Grispos has delivered before. The fund, which charges an annual fee of 1.2%-1.5%, has returned 64.26% since he took over in 2007, outperforming its sector average of 17.82%. Grispos protected his fund’s value during the downturns while many others tanked. It is invested almost entirely in developed markets, with 34% of holdings in America and 17% in Britain. Tesco, which has lost UK market share, is a top ten holding. Another contrarian choice is Fidelity China Special Situations, Anthony Bolton’s poorly performing China fund.

Contact: 020-7963 8100.

Ruffer Equity & General top ten holdings

| Name of holding | % of assets |

|---|---|

| IBM | 4.3% |

| General Dynamics | 2.7% |

| JPMorgan Chase | 2.1% |

| Johnson & Johnson | 2.1% |

| BP | 2.0% |

| Fidelity China Special Situations | 2.0% |

| 1.9% | |

| Groupe Bruxelles Lambert | 1.9% |

| Tesco | 1.9% |

| Aegean Airlines | 1.9% |