Asian investors usually expect high risk and high growth rather than generous dividends. “But times are changing,” says Joanne Hart in The Mail on Sunday. “More Asian businesses realise how important it is to reward shareholders.” And, while investors may struggle to access these companies on their own, funds such as Henderson Far East Income can do so on their behalf.

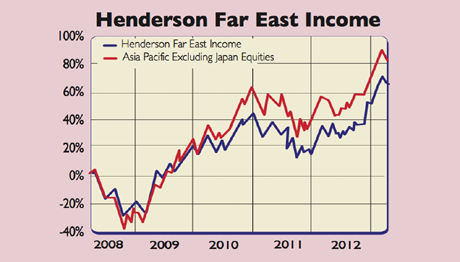

Run by Mike Kerley, who has 15 years’ Asian investment experience, the fund seeks to provide a high level of dividends and long-term capital appreciation by investing in Asia-Pacific stocks. It has delivered a return of 27.7% over one year, 27.4% over three and 63.6% over five years. The annual fee is 1.21%.

Around 18% of the fund is invested in China, while 17.5% is in Australia, 11.8% in Hong Kong and 10.9% in Korean equities. In all it holds stakes in 50 firms, with few counting for more than 3% of the portfolio. Some businesses, such as computer manufacturer Acer and smartphone producer HTC, are export-led, while others, such as Thai food producer Charoen Pokphand, sell their products within Asia.

Asian markets have only seen modest gains recently, but the Australian market has performed well; Kerley recently bought into Australian TV firm Seven West Media. While he believes that the performance of Asian markets as a whole will be “dictated by the political and economic turmoil in Europe” and the strength of the US and Chinese recovery, he is confident of the long-term outlook. His fund remains a decent bet for income-seekers wanting international exposure.

Contact: 0800-856 5656.

Henderson Far East Income Fund top ten holdings

| Name of holding | % of assets |

|---|---|

| Suncorp Group | 3.1% |

| SK Telecom | 2.8% |

| Telecom Corp of New Zealand | 2.7% |

| Bank of China | 2.6% |

| Krung Thai Bank Public Co Ltd | 2.6% |

| Charoen Pokphand Foods PCL | 2.5% |

| Digital China Holdings | 2.5% |

| Myer Holdings Ltd | 2.5% |

| Amcor | 2.5% |

| Asustek Computer Inc | 2.4% |