Chinese banks should be a decent investment. There’s huge room for growth in their home market after all.

But most of these firms aren’t yet good quality businesses. They have a legacy of bad loans and fairly poor risk management. They also have to put government diktats ahead of shareholder interests.

And these problems look set to come to the fore again.

Expect to hear the acronym ‘LGFV’ bandied around quite a bit in the next year or so. Below I’ll explain what they are – and why they spell bad news for banks…

Lending through the recession

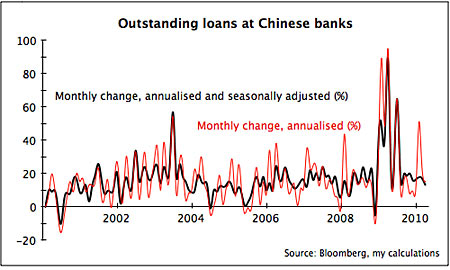

In late 2008, the Chinese government removed the lending restrictions it had imposed to cool the property market in 2007. In fact, it told banks to lend very freely. This – rather than the RMB4trn (US$585bn) in government spending – was China’s real stimulus package in the face of the global recession.

Banks responded. New loans soared, as you can see below. The government is now trying to rein this back in, and the pace seems to be returning to normal, after allowing for seasonal effects. But a huge amount credit flowed into the system very quickly.

Much of this has gone to opaque borrowers called local government financing vehicles (LGFVs), also known as urban development investment corporations (UDICs). These obscure vehicles are starting to draw some attention. Because there’s a good chance this is where the worst bad loan problems will be.

Local governments in China are generally not allowed to borrow from banks or issue bonds. Yet they’re the ones who have to implement much of China’s infrastructure investment. So they get around the borrowing restrictions by setting up LGFVs which they inject with some collateral (i.e. land and other assets). The LGFVs then borrow against the collateral. The loans should ultimately be repaid by cashflows from the project.

The China Banking Regulatory Commission reckons there are more than 8,000 LGFVs with around RMB7trn in loans (around 20% of GDP) and perhaps another RMB3trn in lines of credit that have been arranged but not drawn down. This is almost certainly an underestimate. Victor Shih of Northwestern University estimates a total of RMB11.5trn outstanding and about the same again in undrawn credit (although with the government now clamping down, it seems unlikely the bulk of that will be drawn down).

A boom in bad debts

There may well be a significant amount of risk in these vehicles. First, the scale of the lending suggests there may be plenty of white elephants or outright fraud in them.

Second, even if some projects eventually generate cash, it may be some years before this happens. So LGFVs often meet ongoing costs by selling the land that’s been injected into them. Land sales and prices have been booming since the property market picked back up. The government is now trying to cool this and make sure it doesn’t turn into a widespread bubble.

But if the land market slows, the LGFVs’ main source of development funding (other than fresh loans) will dry up. And local governments will be unable to inject extra capital into them for the same reason.

Given China’s lack of property taxes, land sales are a crucial part of local government revenue – around 20% once you factor in the transfers they get from central government. The money from these sales is the main part of their discretionary spending and goes mainly towards funding development projects.

And of course, some of the revenue from local government land sales will have come from selling land into their LGFVs. This depends on the LGFV being able to borrow, tying the two together even more closely. In short, a lot of LGFVs could end up unable to repay their debts as the government tightens lending.

Small banks will take the worst losses

So where did these loans come from and who will bear any losses? For this, it helps if you understand the structure of the Chinese banking system, which I’ve summarised in the table below.

| Type of bank | Assets (% of total) |

|---|---|

| 5 large state commercial banks | RMB40.1trn (51%) |

| Agricultural Bank of China | |

| Bank of China (HK:3988,CN:601988) | |

| Bank of Communications (HK:3328, CN:601328) | |

| China Construction Bank (HK:939, CN:601939) | |

| Industrial and Commercial Bank of China (HK:1398, CN:601398) | |

| 3 policy banks | RMB7trn (9%) |

| China Development Bank | |

| Export-Import Bank of China | |

| Agricultural Development Bank of China | |

| 12 national joint stock commercial banks | RMB11.7trn (15%) |

| Bohai Bank | |

| Citic Bank (HK:998, CN:601998) | |

| Everbright Bank | |

| Evergrowing Bank | |

| Guangdong Development Bank | |

| Huaxia Bank (CN:600015) | |

| Industrial Bank (CN:601166) | |

| Merchants Bank (HK:3968, CN:600036) | |

| Minsheng Bank (HK:1988, CN:600016) | |

| Shanghai Pudong Development Bank (CN:600000) | |

| Shenzhen Development Bank (CN:000001) | |

| Zheshang Bank | |

| >150 city commercial banks and urban credit co-operatives, including: | RMB5.7trn (7%) |

| Bank of Beijing (CN:601169) | |

| Bank of Nanjing (CN:601009) | |

| Bank of Ningbo (CN:002142) | |

| >5,000 rural commercial banks and credit co-operatives | RMB14trn (18%) |

Lending last year was more or less in line with existing weightings. So about half the new debt was borrowed from the big five banks. Their share of new lending to LGFVs will have been less than their share of overall new lending, but still significant. ICBC, CCB and BOC seem to have lent around RMB1trn to the LGFVs.

However, the loans that go bad will probably be concentrated in the city commercial banks and rural credit co-operatives (together with one of the policy banks, China Development Bank). These have a disproportionate share of the lending. Also, the bigger, best-connected banks will have been offered the best projects, while the white elephants and frauds will have gone to the smaller ones.

How big will these losses be? Obviously, no-one knows right now. But estimates cluster around RMB2.5-3.5trn. That’s equivalent to assuming that all the excess (i.e. above-normal levels) lending last year and expected this year went to LGFVs and will suffer a 50% default rate with no recovery value. That seems a reasonable starting point.

At 7.5-10.5% of GDP or 3-4.5% of banking system assets (and about 2.5 times current bad loan provisions), it’s not a trifle. But it’s manageable. However, it can’t just be left in the banking system. So what will be done?

Bailing out the banks – again

The central government may take on the LGFVs’ liabilities directly. But this is unlikely. The government has recently moved to annul any guarantees provided by local governments for these vehicles, and to ban their future use. The last thing that Beijing wants to do, given its constant struggle to exert its will at a local level, is give the impression that it will always bail out spendthrift municipalities.

Banks might be told to lend to finish projects – a half-painted white elephant is worse than one with a full coat. But it seems likely that failed LGFVs will be allowed to go under. There’s a major precedent for this. The Guangdong International Trust and Investment Corporation – the second-largest local financing vehicle in China at the time – was allowed to go bankrupt in 1999. This didn’t do much for China’s reputation – it had been viewed as implicitly backed by the government. But that didn’t help foreign bondholders, who ultimately saw a recovery rate of 12.5% on their investments.

So instead, the losses will probably be taken by the banks, who will be bailed out as necessary. Many foreign investors assume this will be done as it was earlier this decade. Back then, the banking system was full of bad loans. These came from the banks’ historical requirement to lend to state-owned enterprises whenever they needed it, regardless of ability to pay. At the time, these accounted for around 50% of the loan book and around 20% of GDP.

That couldn’t all be taken as an immediate writedown. Instead, the bad loans were carved out and injected into asset management companies (AMCs). This cleaned up the system somewhat and allowed the banks to be floated (the process of cleaning up ABC, the worst of the four, has taken longer – it will probably float this summer).

Losses on these loans are very high. The recovery rate seems to have been around 20%. But China’s rapid growth in the intervening years means that when the bonds used to finance the AMCs come due and the losses have to be recognised, the cost will be small – probably around 4% of GDP.

Four ways to a bailout

Doing the same again would probably be the worst-case scenario this time. Instead, the listed banks would first try to raise more funds to replenish their capital buffers. This is already happening. The president of ICBC has said that the four big listed banks will have to raise RMB480bn in the next few years.

These listed banks will probably be the least affected directly. But even if a bank has a relatively clean loan book, we can’t assume it will be immune from having to carry the can. Instead, this might be seen as a chance to consolidate the Chinese banking industry, with hundreds of wrecked smaller banks being taken over by larger firms. So healthy banks could need to tap shareholders for cash to meet the losses of anything they buy.

Banks can also try to write off some of the loans over time rather than all at once. The banking sector earned RMB0.6trn in net profit in 2008. If banks can drag out the recognition of bad loans over a few years and offset some against earnings each time, they can deal with the problem that way. This is standard banking practice around the world and not just after a crisis. Every business cycle leaves some banks that are technically bankrupt but are allowed to earn their way back to health.

This will be helped by the fact that most of these loans are relatively long-term ones, meaning that losses will naturally be recognised slowly. Loans for projects that will never earn a genuine return but could make enough to pay back the money eventually will presumably be restructured and given time to pay.

Also, state-owned enterprises in other sectors with strong balance sheets might be pushed to inject some capital into the banks. We’ve already seen China Mobile take a 20% stake in Shanghai Pudong Development Bank for RMB40bn. This was explained as being a way to build mobile banking, but has proved unpopular with investors.

And whether this is a good idea is another matter. Think back to various US firms taking stakes in Wall Street in the 1970s and 1980s, such as Firestone Tire and Drexel, GE and Kidder Peabody, and Berkshire and Salomon Brothers, none of which ended happily. But it seems plausible.

If the size of the losses and the speed with which they grow proves too large for these solutions, then the government will have to step in. While this would add to its debt levels, this wouldn’t be too much of a strain, given China’s high savings rate and lack of dependence on foreign funding. The current debt burden is relatively low by international standards, even when you put the bad loans in the AMCs and policy bank borrowing on balance sheet.

So this problem will need to be sorted out, but if won’t knock China off the rails. And in fact, picking up a tab of this size may well be regarded as an acceptable cost, given the much worse year the economy would have had without the lending boost.

Avoid banks until this is resolved

Hopefully, the aftermath might spur further reforms. Lending standards in the banking sector need to be improved so this doesn’t happen again. And local government financing should also be fixed: infrastructure spending could be financed directly from the centre, while local authorities could be made to be more transparent and allowed to issue their own bonds to finance projects in a much more open way.

For investors, it should remind them that banking sector problems are a normal part of development and China won’t escape. It is as subject to boom and bust as anywhere else in the world.

But while this is working through, I don’t think it makes sense to be investing in Chinese banks. The problem might turn out to be much less serious than it seems – but it doesn’t really seem worth taking the chance.

If there is a shake-out and a clean-up of the system, it may finally provide a good opportunity. Depending on how things look when this works through, I’m inclined to think the best value will probably emerge in the second-tier national banks – Citic Bank, Merchants Bank and Minsheng Bank being the three available to foreign investors.