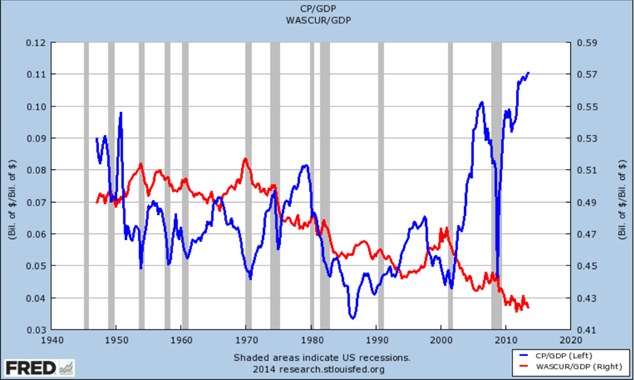

We’ve written several times here that we don’t think the current balance between corporate profits and ordinary salaries is sustainable. The chart below makes the point nicely.

Profits in the US have risen hugely as a percent of GDP in the last decade or so. Wages have fallen as a percentage of GDP – from near 50% to near 40% – and are now far from their historical average level.

If you believe at all in reversion to the mean, you will wonder how long this can last. The answer might be not as long as the deflationistas might think.

In his recent letter to investors, Crispin Odey looks at “how differently private sector wages are growing in America for unionised labour forces and non-unionised”. The second chart (from Odey) shows this.

It suggests, as Odey puts it, “that there is huge value in being in a union at the moment.” It also suggests that those who are not in unions don’t yet appreciate the negotiating power they have with their employers given that unemployment is currently sitting at only 5.6% in the US. Surely they soon will.

This is good news for workers – why should their share of GDP keep falling?

But, as I have said before, it is very bad news for investors: it guarantees falling profits margins and that is something that US stock market valuations are definitely not pricing in.