It’s been an awful year for small caps. The FTSE Small Cap Index is down 48% this year against a 38% fall for the FTSE 100, while the Alternative Investment Market is down 61% since January. And prospects will remain bleak if credit for small firms continues to dry up. But bargain hunters should be cheered by the performance of Citywire AAA-rated Harry Nimmo, “one of the UK’s most respected small-cap fund managers”.

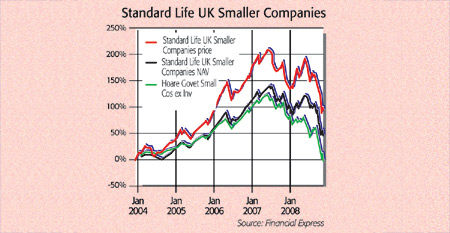

Nimmo’s fund, Standard Life UK Smaller Companies (LSE:SLS), is down a relatively respectable 36% year-to-date, after the Edinburgh-based manager moved into more defensive stocks earlier this year. “We like to buy tomorrow’s larger companies today,” he says. In addition to power-supply protection group Chloride and defence group Chemring, the fund holds online retailer ASOS and funeral home group Dignity. “ASOS has the opportunity to grow not a little bit but an awful lot, and become a very big company.”

A bottom-up stock picker, Nimmo tends to avoid value investing (“I don’t like to catch a falling knife”), instead focusing on firms with net cash and strong overseas earnings. But he does believe software firm Aveva has been unfairly punished by its 30% exposure to shipping tankers. It’s down 66% this year, even though 75% of its market value is represented by cash. “It’s a business that is far from finished.” Tough times for small companies will continue, but you should keep this fund on your radar for when better times return.

Contact: 0131-225 2345

| Standard Life UK Smaller Companies top ten holdings | |

| Name of holding | % of assets |

| ASOS | 5.30 |

| Aveva Group | 4.30 |

| Chloride Group | 3.50 |

| Paypoint | 3.00 |

| Telecom Plus | 3.00 |

| Abcam | 2.70 |

| Playtech | 2.60 |

| Connaught | 2.50 |

| JKX Oil & Gas | 2.50 |

| Paddy Power | 2.40 |