Where have all the ‘locusts’ gone? Before the credit crunch, private-equity (PE) firms were swarming across Britain, snapping up high-street brands such as Boots and Foxtons. Claiming to be experts in company restructuring (cost cutting, in effect), and armed with cheap debt, at one point no listed firm looked too big to swallow. The aim was simple: buy, ‘improve’, and resell fast.

But times have changed. Research firm Dealogic reckons 25 deals totalling $39bn have been withdrawn this year. Meanwhile, Terra Firma boss Guy Hands, quoted in the FT, believes “returns for the vast majority of firms are coming down”. No more so than those struck at the height of the PE boom in 2006 and 2007, for which future prospects are “negative, very negative”. So difficult is the current climate, says the FT’s David Stevenson, that “the fact that no listed PE firm has gone bust is a constant surprise to me”. So what’s gone wrong?

First, access to cheap debt has all but disappeared as overstretched banks rein in lending. And with no debt, many PE firms can’t fund acquisitions or achieve the magnified (‘leveraged’) returns for which PE is renowned. Worse, many face big cash calls from disgruntled investors. These can be reduced by freezing redemptions, but that can threaten future funding. That’s because institutions typically drip-feed commited cash into a PE fund over long periods stretching out for years. And many rely on early-year investments being returned (with interest) to fund later ones.

As a result, many PE firms have little option but to cut back investment and dump assets. That in turn means that a number of listed PE fund of funds, which take stakes in smaller individual PE funds, now trade at big discounts to their underlying net asset values. Partners Group Global Opportunities (PGGO:LN), for example, is trading at a 61% discount to its net asset value, while Lehman Brothers PE (LBPE:AS) is now at a 67% discount.

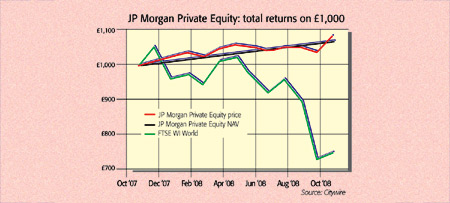

But are these genuine bargains? Buyers need to be careful, says Elaine Small at Paul Capital Private Equity on Reuters. “We would rather pay a full and fair price for companies with (strong) characteristics than get a big discount on a firm that’s going to go bankrupt.” With what Stevenson calls a “tsunami of debt to be renegotiated or abandoned in 2009”, the worst may be to come. So although “for the adventurous” he tips UK-listed JP Morgan PE (JPEL:LN) on a 21% discount (see chart, above), we agree with Tim Price of PFP Wealth Management, who suggests you steer clear of PE altogether for now.