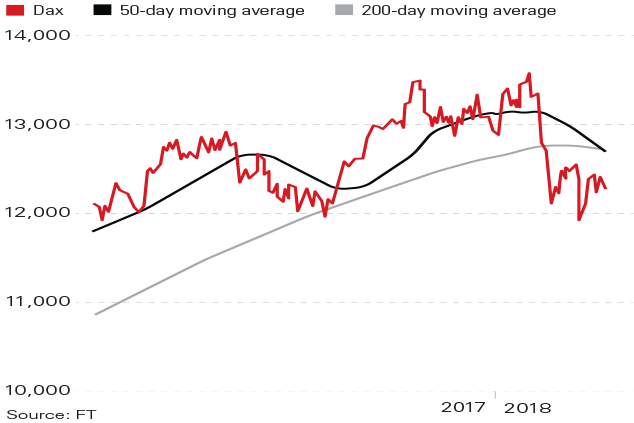

Last week, Germany’s benchmark index, the Dax 30, produced a “death cross”: a widely watched technical indicator that often heralds further falls. It occurs when the 50-day moving average of a share or index slips below the 200-day moving average.

It is apparently especially worrying when both averages are declining, as is currently the case. In the last decade there have been four death crosses in the Dax, Matthew Maley of Miller Tabak + Co told the Financial Times, “and they were all followed by significant declines”.

The fundamentals aren’t looking very encouraging either: Germany’s heavyweight industrial and car stocks are considered to be vulnerable to further US protectionism.

Viewpoint

“World markets are taking another step to embrace China. Bloomberg will add the country’s [government debt and bonds issued by state-backed banks] to the Bloomberg Barclays Global Aggregate index [to] attract foreign investors and encourage more liberalisation… [China’s] $9trn domestic bond market is the world’s third largest after the United States and Japan… but most international investors have little exposure… The bond index news landed one day after US president Donald Trump announced new tariffs on Chinese imports… aimed at reducing the US trade deficit with China, which hit $375bn in 2017. But money flows vastly exceed those of goods and services, with daily trading in currencies averaging more than $5trn… A move that encourages more financial transactions with China offsets Trump’s barriers to traditional trade.”

Tom Buerkle, Breakingviews