Last week I found myself in Seoul.

What a city!

It’s not what you’d call beautiful – far from it – but this is one happening place.

And it must be worthy of consideration as an investor.

South Korea’s economic miracle

It was known as “the miracle on the Han river”, and it surely is one of the great economic booms not just of the 20th century, but of all history.

By the end of the Korean War, in 1953, South Korea was little more than rubble. By the early 1960s, GDP per head was still sitting at around $64. That’s a meaningless number out of context, so let’s just say that South Korea was among the poorest countries in the world.

Today, South Korean GDP per head is more than $30,000; it rivals much of Europe, including France and Finland. And from what I can see, there’s no reason that South Korea’s GDP per head can’t grow to be comfortably in excess of ours here in the West.

Korea is not strikingly rich in natural resources. There isn’t much oil or natural gas to speak of; it’s not especially abundant in minerals; it’s quite mountainous and so lacks the vast expanses of fertile plains that could give rise to an internationally competitive agricultural industry; and it’s now largely deforested, so timber’s out.

Its biggest resource is its people: determined, direct, hard working and extremely ambitious. Galvanised by an especially strong Confucian spirit of the collective, the country has manufactured and traded its way to its wealth. From what I have seen here, the people are hungry for more.

You’ll no doubt be familiar with many of the country’s automobile and electronic giants: the likes of Samsung, LG, Hyundai and Kia. But there’s a lot more to the place than these brands.

Seoul has turned itself into the world’s most wired city. You can get free Wi-Fi pretty much all over town. Everywhere you look, people are staring into their phones, with a tech-savvy sophistication that Europe’s ageing population just does not have. That’s another feature of the city: how young every one is.

Consumer culture is booming. Trade is booming. The city is crowded and buzzing. “K-pop” (of which Gangnam Style is the most famous example internationally) has helped to turn it into the go-to, trendy city of east Asia. It’s packed with tourists.

We visited a 14-storey (!) department store, dedicated to selling duty-free goods to foreign buyers, especially Chinese and Russians. Several floors are devoted to cosmetic products alone – South Korea is one of the leading players in the global beauty industry.

Are nose jobs vanity – or an unsentimental investment in getting ahead?

That another thing stands out: how looks-driven these people are. The Koreans are frank and direct about it in a way that a European might find embarrassing. Take plastic surgery. Seoul is now the world capital of plastic surgery, accounting for 25% of the global industry’s turnover (and more than 25% of its operations).

Around 300,000 medical tourists come here every year for cosmetic surgery. Just ten years ago, that number was pretty much non-existent. Three quarters of the patients are female, and the majority are Chinese, although Russians come in their droves as well.

Meanwhile, 15% of Korean men, including a former president, have had surgery, according to one study. And a full half of Korean women in their 20s have had a cosmetic treatment of some sort. It’s now seen as normal for a girl to be given eyelid surgery or a nose job as a school leaving present.

I find this disturbing. The Koreans’ attitude is quite different. We might dismiss cosmetic surgery as vanity. The Koreans see it as self-improvement – an investment, even.

Like a good education, good looks are a way to a better job, a better career and a better marriage partner. The better looking you are, runs the logic, the better your life chances. And the unerringly ambitious Koreans are prepared to do whatever it takes.

(Unpalatable as we may find it, this is statistically backed up, by the way, in a study called Why Beauty Matters, by University of Michigan information scientists Markus Mobius and Tanya Rosenblat. Attractive people earn on average 12.5% more than ordinary-looking people, and are assumed to have qualities they may not in fact have, in a process known as the “halo effect”.)

Just to be clear, I’m not advocating plastic surgery. The whole thing makes me feel uncomfortable. I’m just telling the story to demonstrate the lengths Koreans are prepared to go to improve their lot.

So how does this dynamic culture and ambition translate into stockmarket returns?

The end of the Korean discount?

For many years South Korean companies have traded at lower price-to-earnings (p/e) multiples than their global peers. The MSCI Korea Index, for example, has a p/e of around 10, according to Bloomberg, while Japan’s is closer to 16 and the MSCI World Index sits at 17. Japanese companies’ price-to-book value can be as much as 50% higher than Korean. This is known at the Korea discount.

Part of the reason for this is that something like 80% of GDP is commanded by family-run conglomerates, known as chaebols. Transparency has been lacking, corporate governance standards poor and corruption scandals plentiful and large.

South Korea’s former president, Park Geun-hye, and the heads of Samsung and Lotte, two of the country’s biggest chaebols, have all been charged with bribery. There have been protests aplenty and South Korea’s new president, Moon Jae-in, has promised to reform the giant companies.

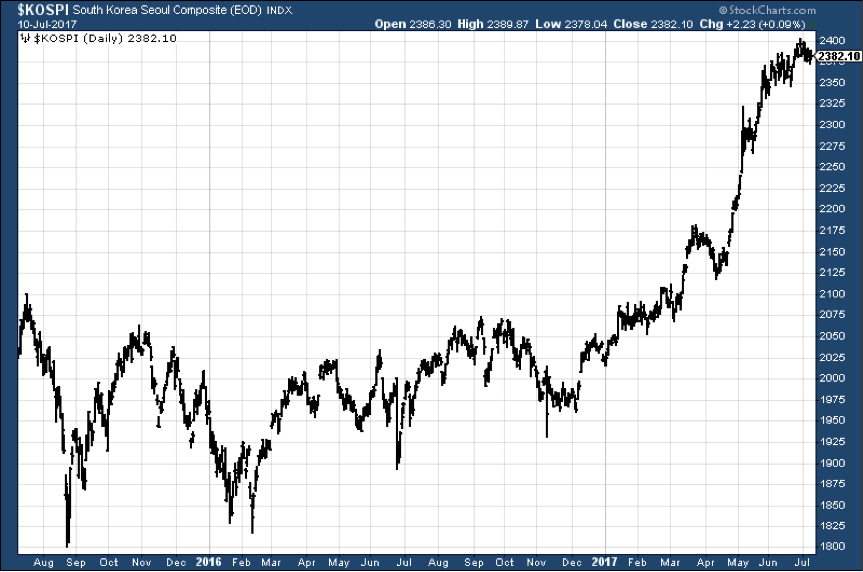

I’m not holding my breath, but the recent performance of the Kospi – the Korean stockmarket – suggests that some kind of improvement, let’s say, is on its way. After many years of range-bound performance, in late 2016 the Kospi broke out and it has continued its uptrend, making new high after new high. It’s up 18% this year.

The other concern, of course, is its irascible neighbour to the north, which was busy with its missiles in the week I was there. I’m not going to pretend to have any great insight into what will happen – it wouldn’t surprise me to see an Asian version of what happened in Germany, in which North Korea eventually crumbles under its own weight – but the truth is I have no idea.

The market fears both open war and reunification – either of which would of course, be extremely disruptive to the economy. But putting any realistic timescale on that sort of event is beyond me.

At the end of the day, investing in Korea – like any investment – is not without its risks, but the bottom line is that I was deeply impressed by the Korean people. An investment in Korea is an investment in such people.

The easiest way to play South Korea as a London investor is to buy the exchange-traded fund, iShares MSCI Korea UCITS ETF (LSE: IKOR), which tracks the MSCI Korea Index. The main caveat with is that is over a quarter weighted to electronics giant Samsung. Given Samsung’s dominance in the smartphone arena and relatively cheap rating, I don’t have a major concern about this, but it’s something to be aware of.