This article is taken from our FREE daily investment email Money Morning.

Every day, MoneyWeek’s executive editor John Stepek and guest contributors explain how current economic and political developments are affecting the markets and your wealth, and give you pointers on how you can profit.

.

#ramaindiv

{

margin-left: 10px;

float: right;

background-color: #eeeeee;

width: 47%;

}

.ratopdiv

{

padding: 10px 10px 0px 10px;

background-color: #eeeeee;

}

.rabluediv

{

height: auto;

border-bottom: 5px solid #2967CD;

}

.ralinksdiv

{

padding: 10px;

background-color: #eeeeee;

border-bottom: 1px solid #999999;

}

.rasubsdiv

{

padding: 10px 10px 0px 10px;

background-color: #eeeeee;

}

@media only screen and (max-width: 600px)

{

#ramaindiv {width: 100%;}

}

In this week’s issue of MoneyWeek magazine

●

The vultures are circling over the corpse of corporate Britain…

●

Don’t let Facebook’s woes put you off technology stocks

●

The robo-adviser revolution gathers pace

●

Don’t buy the bubbles

●

Alliance Trust turns over a new leaf

● Share tips of the week

Not a subscriber? Sign up here

Today we consider the art of short-selling.

The reputation of short-sellers is mixed. When markets capitulate and panic is everywhere, the short-seller is often vilified. But, at the same time, the best short sellers have acquired near legendary status.

The risks a short-seller is taking are huge. They can lose their original stake many times over. Even if they are right about a market, if their timing is wrong, they can quickly find themselves underwater. They need to have considerable nerve and belief in what they are doing. Good research will often be what underpins that belief.

And the result of good research is often that scams are uncovered.

It’s easy to say something is a bubble – it’s much harder to profit from it

If you think that an asset will rise in price and you buy it, you are “long”. If you think it will fall, you sell it and you are “short”. Simples.

But there’s a problem: you can’t sell something you don’t own. If you want to short something, you have to borrow it from somewhere. You give it back when you cover your short.

Some consider short-selling to be immoral. When a market capitulates and the mob start baying, the finger of blame is pointed at the short-seller. In 2015, short-selling was banned in China in reaction to market falls. In 2008 the practice came under heavy scrutiny and was banned in Australia, Canada and in some parts of Europe. In 1929 they banned it in the US.

But the short-seller is providing an essential market service. As well as bringing liquidity to a falling market when they cover, it is because of short sellers that many frauds are exposed.

And it’s not like the short-seller isn’t taking risks. It is a dangerous art. If the short-seller is wrong and the asset in question rises, they pay a hefty price. An asset can only fall as far as zero, but there is, in theory, no limit to how high it can rise in price. If a short-seller sells company X at £100 and it rises to £1,000, they’ve lost a great deal more than their original stake. Such a scenario is particularly common when markets get irrational and prices exuberant.

Many commentators, for example, declare that, say, bitcoin or Tesla is a bubble, but, exceptional market timers aside, anyone who shorted either in 2016 or 2017 got hammered. Any old economist can declare something is a bubble. Very few are clever enough to actually make money from it.

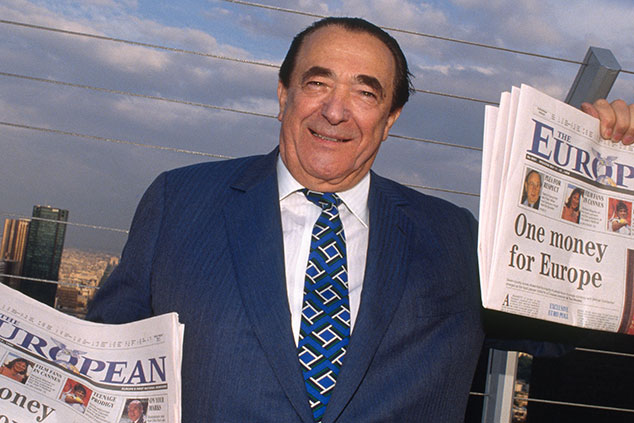

How Britain’s best-known short-seller uncovered Robert Maxwell’s fraud

Britain’s most notorious short-seller is Simon Cawkwell – Evil Knievel – and at the weekend I enjoyed listening to an interview he had conducted on the James Delingpole podcast a few months back, in which he described how his first real break came with Maxwell Communications in 1990-91.

Today we know that Robert Maxwell was a pension-thieving crook. Back then, it wasn’t so clear.

“Provided that you started reading every line [of the accounts] on the basis that it was probably or possibly a lie,” says Cawkwell, “you got to the point when you knew the whole thing was a lie”.

Together with a friend he wrote a note “explaining the defects in Maxwell’s accounts. There was nothing abusive,” he says. “In fact, it was very mild in tone. We just concentrated on facts elicited from the accounts which Maxwell himself had signed. It was possible to show that insolvency was not a possibility, but a probability – to put it mildly.”

As a result of Cawkwell’s note, the stock sold off. However, Maxwell went to great lengths to drive the stock back up. Over the next nine months, the price of Maxwell Communication Corporation more or less doubled. Bankers had been lending him money ahead of the stock, and Maxwell had been buying.

Cawkwell had covered, but as the share price rose, he had gone short again. He was now badly underwater. “It was very difficult to borrow the stock,” says Cawkwell. If he was an hour or two late delivering, he got bought back in, and “it became very expensive.” In effect, Maxwell and his bankers were propping the stock up, and it was only Cawkwell’s research and trust in his own ability to read accounts that gave him the conviction he needed to hang on.

It was a good thing he did. Eventually, “the day came when Maxwell’s consumption of cash across his personal affairs and with other so-called investments ran out,” he says. “The price of Maxwell Communication Corporation started to descend.”

By now, “Maxwell had no means of manipulating the price upwards. The price went down and down. As the price went down, the bankers said – we want our money back. But Maxwell had no money, with the result that the bankers sold the stock that they held as collateral down.

“By their selling the stock down, they triggered more defaults on the margin, with the result that Maxwell had to sell yet more stock to raise money.” That, of course, pushed the stock down further.

Looking back now, it sounds easy – but it wasn’t.

Something similar happened in 2008 – and the story was famously told in the Oscar-winning film The Big Short (based on the Michael Lewis book of the same name). Even although the short-sellers knew they were right, there was a period when their trade had gone against them and they were deeply underwater, with big banks, who did not want to be found out, on the other side of the trade.

It took great conviction to maintain their position. But the research they had done, gave them the belief they needed. They knew they were right.

Cawkwell’s research exposed the giant fraud that was Maxwell Communications. Similarly, bogus activity was uncovered in 2008. The role of the short-seller is extremely important to the health of an economy. If you are a CEO not doing what you should be, it’s likely the short-seller will find you out.

“I knew I had done something that anybody could have done,” said Cawkwell, “provided they had the courage to believe in themselves. I had shown that courage, where others did not. I made the money. They didn’t.”

If a company you own is targeted by short-sellers, pay attention

Here’s a much more recent example. “Take a look at this”, my fellow financial writer, Tom Winnifrith, said to me in an email last week, pointing, pointed me in the direction of a report from New York hedge fund Quintessential Capital Management (QCM), which previously exposed fraud at Aim-listed technology company Globo.

The presentation argues that the company sales are a fraction of what has been reported, that profits could be negative, and that business is shrinking – not growing, as claimed. In addition, the report suggests Folli Follie has overstated the number of outlets it has worldwide. (QCM’s Gabriel Grego says they went to inspect some global outlets in Japan, the US and China, and found empty retail space where outlets were supposed to be).

Folli Follie says that the report is “unfounded, false, defamatory and misleading”. Meanwhile, the Greek regulator has asked the company to have its 2017 accounts looked at by an independent auditor.

We’ll see what comes out of this. But if I was a Folli Follie shareholder, I’d be looking for a point-by-point rebuttal of what looks like a very well-researched report. For sure, QCM has now made a lot of money. But if its report is correct, then it’s also doing a service for the wider market.

The moral is clear: if you want to be a good short-seller, you need to make sure your research is good. If your research is right, that will give you the belief you need. DYOR, as they say.

And if you are on the other side of the trade – if a company you are invested in is targeted by short sellers – pay attention. You might not like it – the management certainly won’t. But given the risks involved, crying “wolf” is not a sensible strategy for a short-seller.

You might not like what they’re saying. But it’s up to you to take their arguments seriously and – if you plan to stay long – prove those arguments wrong. Simply ignoring it could end up being very expensive indeed.