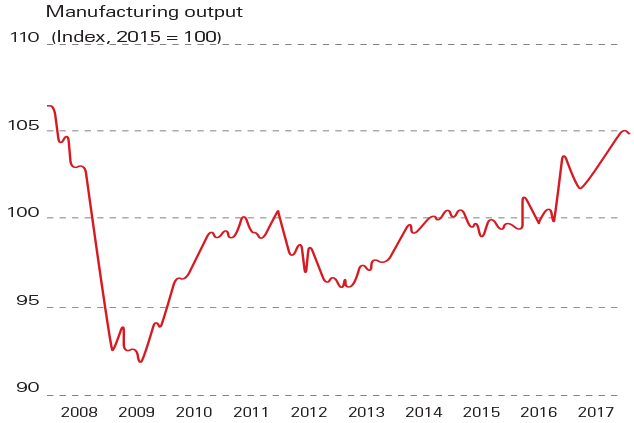

Has this been “another false dawn for factories”, asks David Smith in The Sunday Times. There have been several occasions in recent years when a rise in UK manufacturing output did not in fact herald the start of a sustained upswing. George Osborne’s widely trumpeted “march of the makers” a few years ago turned out to be a “gentle stroll”. An upturn in 2014 faltered too. Now the worry is that the post-Brexit surge could be petering out. In the first quarter manufacturing output expanded by a mere 0.2%, and the PMI survey tracking activity in the sector slipped to a 17-month low in April. Overall output is still only just back to pre-crisis levels.

Viewpoint

“[Bank of England Governor Mark] Carney [is] bouncing around a lot [with his hints on the likelihood of interest-rate hikes], confusing the markets… In some markets, borrowing costs seem to be detached from the Bank base rate… Last week, RBS chief executive Ross McEwan noted that the mortgage market is so competitive that the cost of new mortgage deals has actually gone down since last November’s rate rise. That on its own seems to me like a good enough reason to raise rates again. And if the economy is really so fragile it can’t cope with a quarter-point rate rise, well, we might as well find that out.Waiting for the perfect time to raise interest rates is like waiting for the perfect time to get married. If you do that, you never will. So let’s put rates up, if only so we’ve something to cut if things do go really bad.”

Simon English,

London Evening Standard