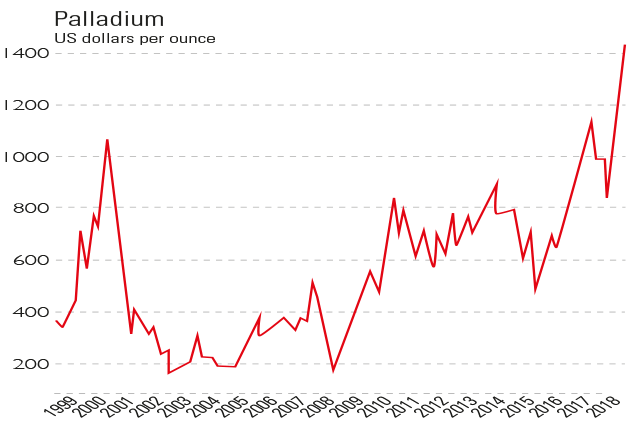

The price of palladium has hit a new record of $1,495 per ounce. Over the past six months, the price has risen by 70%. Last year it overtook the gold price, and it is also more highly valued than its sister metal, platinum. But this is “unlikely to last”,

says Ross Strachan of Capital Economics. Palladium is used in catalytic converters for petrol vehicles, and in batteries for hybrid cars. Supply rose sharply in 2018, while the current slowdown in car sales will hit demand and “should cause prices to come off the boil”.

The biggest risk is the transition to electric vehicles, which do not produce emissions or need converters, says John Gapper in the Financial Times. If governments incentivise consumers to go electric, the metal could slide.

Viewpoint

“Gold keeps some strange company. Ardent gold bugs seem to know a lot about firearms… and the best ways to preserve food… Consider the alternatives, though. The euro is flawed. It has no unique sovereign issuer to stand behind it. And the yuan is not a currency you can trade easily. As for the yen and the Swiss franc, past form suggests both countries are likely to cap a rise in their currencies by printing more of them… short-term interest rates have been negative for years…

“By contrast gold’s yield – zero – seems almost racy… the dollar still accounts for the bulk of official reserves but tellingly, the managers of those rainy-day funds seem a mite concerned that they are crammed into the same spot. The share of dollars in the $10.7trn of reserves reported to the IMF has dropped from more than 65% in late 2016 to less than 62% in the latest figures.”

Buttonwood, The Economist