Welcome back. Merryn’s away this week, so we don’t have a new podcast, but if you missed last week’s, we cover everything from customs unions to the democratic deficit to our one point of agreement with Jeremy Corbyn. Catch up here.

And your regular reminder – if you don’t already subscribe to MoneyWeek, do it now – you get your first six issues free when you sign up. We have a much bigger problem than Brexit on the cover this week – the rise of antibiotic-resistant superbugs. Thankfully some companies are trying to tackle the issue, and we show you how to invest in them. And what better way to distract from Brexit than by reading about a genuine crisis?

Meanwhile, if you missed any Money Mornings this week, here are the links.

Monday: Investors shouldn’t worry too much about a recession – here’s why

Tuesday: “It’s the era of socially responsible investment – ooh hello, Saudi Aramco”

Wednesday: Bitcoin has been bouncing – but is the bear market really behind us?

Thursday: With Brexit retreating even further into the long grass, the UK looks cheap

Friday: Amazon boss Jeff Bezos is calling for a wage-price spiral – inflation is coming

Oh, and if you don’t already have a copy of my book on contrarian investing, The Sceptical Investor, you can get a 25% discount right here.

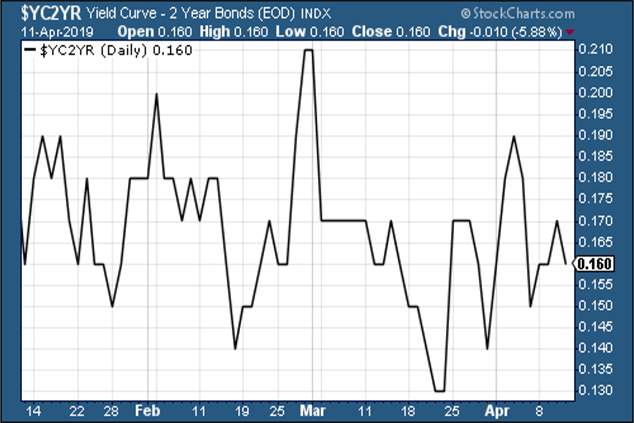

Over to the charts. The yield curve (remind yourself of what it is here) hasn’t done anything remarkable this week. It’s still not signalling a recession, but it’s still too close for comfort.

The chart below shows the difference (the “spread”) between what it costs the US government to borrow money over ten years and what it costs over two. Once this number turns negative, the yield curve has inverted which almost always signals a recession (although perhaps not for up to two years).

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) was having a better week but then took a battering as jobs data came in better than expected. That’s partly because the minutes from the latest Federal Reserve meeting suggested that the Fed hasn’t entirely given up on the idea of being able to raise interest rates should economic news improve.

Meanwhile, on Thursday, US employment data came in very strong (more on that below) and producer price inflation (also known as “pipeline inflation”) was much stronger than expected. Inflation is often good for gold, but only as long as interest rates lag behind. For the moment, the market – even now – still isn’t convinced that the Fed doesn’t have an itchy trigger finger.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – rallied somewhat for the same reasons that gold slipped back.

(DXY: three months)

As far as ten-year yields on the world’s major developed-market bonds go, the US was little changed after last week’s sharp bounce, as was Germany. Japan retreated somewhat as the charts below show.

(Ten-year US Treasury yield: three months)

(Ten-year Japanese government bond yield: three months)

(Ten-year bund yield: three months)

Copper was looking a little fragile, despite hopes that a trade truce between China and the US is nearly a done deal.

(Copper: three months)

The Aussie dollar – our favourite indicator of the state of the Chinese economy – rallied briefly this week, mainly because the head of the Aussie central bank gave a less dovish update than expected this week. However, it lost most of its rebound by the end of the week.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin continued its recent strong showing to push above the $5,000 mark this week. As my colleague Dominic said in Money Morning this week, the level of excitement suggests that you should proceed with caution – Bitcoin has been bouncing – but is the bear market really behind us?

(Bitcoin: ten days)

The big chart news for this week is that we finally got it – a fresh low for US welfare claims. The four-week moving average of weekly US jobless claims fell to 207,000, the lowest level in nearly 50 years, as weekly claims fell to an astoundingly low 196,000 (also a half-century low).

That beats the most recent four-week moving average trough of 210,500, which was set on 22 September last year. Why do we care about that? Because in the past, David Rosenberg of Gluskin Sheff has noted that US stocks usually don’t peak until after this four-week moving average has hit a low for the cycle. You then get a recession about a year later. (It’s a tiny sample size so don’t take this as gospel, but it’s interesting.)

This suggests in turn that the S&P 500 is likely to rise back above its most recent high, which was set at around 2,950 in October. We’re not far off that right now, so it wouldn’t be a big ask. It would also make a certain amount of sense, given that it’s the year before US elections (typically a good year for stocks).

Like I said – it’s a small sample size. But it is definitely a head-scratcher for the bears.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) kept rallying this week, as “It’s the era of socially responsible investment – ooh hello, Saudi Aramco”

(Brent crude oil: three months)

Internet giant Amazon this week was closing in on the $1,850 mark. As I’ve said before, I’m not a chartist, but it’s pretty clear that this level represents “resistance” (a point at which many investors have sold in the past). And if Amazon gets back above it in a convincing manner, then I have to say, that will persuade me that we’re going to see the US market set new highs before we see a recession.

(Amazon: ten months)

Shares in electric-car group Tesla are still stuck in the doldrums. There was a report of the company pausing its plans to expand its battery-producing “gigafactory”, although Tesla disputed the report.

(Tesla: three months)

Have a great weekend. I’m on holiday next week – instead, occasional MoneyWeek contributor Eoin Treacy will be looking at the topic of gold and gold investment.