This article is taken from our FREE daily investment email Money Morning.

Every day, MoneyWeek’s executive editor John Stepek and guest contributors explain how current economic and political developments are affecting the markets and your wealth, and give you pointers on how you can profit.

Where’s inflation going to come from?

It’s the big question right now. Markets are clearly sceptical about it. Government bonds across the globe, from Germany to Japan, are sitting on negative yields (in other words, you pay interest to hold them, rather than the other way about).

Yet if you listen to the mood music for even a moment, pressure is building by the day.

One way or another, politics is going to force the issue. And I suspect that at that point, we’ll find that it’s a lot easier to spark inflation than we all assume…

A quick selection of unusual comments from top executives

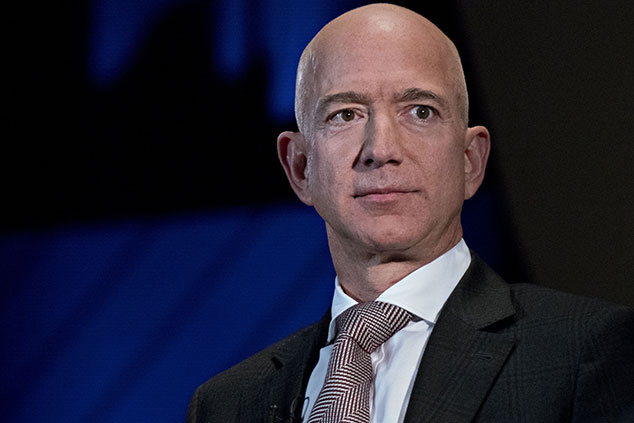

“Today I challenge our top retail competitors (you know who you are!) to match our employee benefits and our $15 minimum wage. Do it! Better yet, go to $16 and throw the gauntlet back at us. It’s a kind of competition that will benefit everyone.”

That was Jeff Bezos, CEO of Amazon, calling for a wage-price spiral (I hike wages, you hike wages to compete, costs go up, demand goes up, prices go up, etc.)

“Hey retail competitors out there (you know who you are) how about paying your taxes?”

That was Dan Bartlett, Walmart’s executive vice president of corporate affairs, responding by calling on Amazon to pay more taxes than is legally necessary.

“The American Dream is alive – but fraying for many.”

That’s Jamie Dimon, CEO of investment bank JPMorgan Chase, in his latest letter to shareholders, showing that he cares about the little people. (Watch this video to see why Dimon is only going to be feeling ever more pressure on this front.)

“I believe that capitalism is not working well for most Americans.”

That’s Ray Dalio, probably the most successful hedge fund manager in the world, declaring that the system that made him rich, is flawed, as part of a long letter entitled “Why and how capitalism needs to be reformed”.

Some of you will agree with these sentiments. Some of you will think they are nonsense. Some of you will consider the men in question to be hypocrites, others will think they are naive, a few of you might think they are brave.

It doesn’t matter. From an investment point of view, your personal view on this – as with your personal view on Brexit or Trump or the price of fishcakes – is irrelevant. You have to attempt to see the world as it is, not as you wish it would be.

So what do all of these things have in common?

They all involve the wealthy in society hearing the drums banging for revolution. They’re circling the wagons and figuring out how to give back a little before they are forced to give back a lot. In short, it all boils down to “more money for the little people”.

Now, believe me when I say that more money for the “little people” does not mean that the “big people” give up their money or power.

That’s why Facebook wants to be regulated. So that its potential competitors are strangled before they even start to grow. (Do you know anyone under the age of 20 who uses Facebook? There’s a good reason for it to try to shore up its dominance while the going is still good.)

That’s why Amazon wants to drive up wages for the retail sector. As well as giving him a bone to toss to some of his critics, it’s a cost that Amazon can afford which many of its rivals cannot.

Less competition plus higher wages. That’s a recipe for inflation, I’d say.

Yes, but when will inflation take off?

You might ask: when will this happen? But that’s probably the wrong question. It’s happening now. This is a process. Everything I’ve described above represents one or more gradual steps in this process.

The reality is that inflation is already gradually ticking higher. It’s being widely ignored because I suspect generational memory means that no one under the age of 50 in the developed world has really experienced anything like “problem” inflation as an adult.

But oil prices are rising. Producer price inflation (that’s inflation in the pipeline) rose faster than expected in the US last month. And with every step closer to the US election, the louder the politicians compete with each other to be seen to care.

The question you really want to ask is: when will this make itself felt in financial markets? The answer to that, of course, is that no one knows. But you don’t have to get the timing spot on to prepare for it.

Own some gold (as we always tell you). Be careful of the more politically vulnerable sectors. Elevated political risk doesn’t necessarily mean you shouldn’t own them – you just have to take the risk into account when you consider whether you are being sufficiently compensated for owning the investment.

It’s a similar story for income investments – if there is a higher-than-anticipated risk of inflation rising or politics taking a more aggressively inflationary turn, then are you really being compensated for that?

For example, does it make sense that some bonds issued by the Greek government yield less than their US equivalents (one for the “strange, but true” file)? Is it a good idea to own bonds with negative yields (ones that in effect, charge you to own them)? Probably not.

We’ll be covering all of this in more detail in an upcoming issue of MoneyWeek magazine. If you’re not already a subscriber, you can get your first six issue free by signing up here.